Page 241 - ELT_15th July 2020_Vol 373_Part 2

P. 241

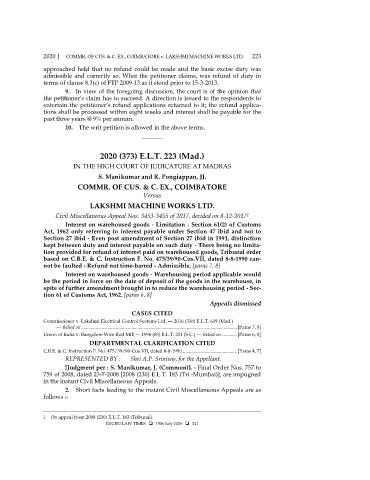

2020 ] COMMR. OF CUS. & C. EX., COIMBATORE v. LAKSHMI MACHINE WORKS LTD. 223

approached held that no refund could be made and the basic excise duty was

admissible and correctly so. What the petitioner claims, was refund of duty in

terms of clause 8.3(c) of FTP 2009-13 as it stood prior to 15-3-2013.

9. In view of the foregoing discussion, the court is of the opinion that

the petitioner’s claim has to succeed. A direction is issued to the respondents to

entertain the petitioner’s refund applications returned to it; the refund applica-

tions shall be processed within eight weeks and interest shall be payable for the

past three years @ 9% per annum.

10. The writ petition is allowed in the above terms.

_______

2020 (373) E.L.T. 223 (Mad.)

IN THE HIGH COURT OF JUDICATURE AT MADRAS

S. Manikumar and R. Pongiappan, JJ.

COMMR. OF CUS. & C. EX., COIMBATORE

Versus

LAKSHMI MACHINE WORKS LTD.

Civil Miscellaneous Appeal Nos. 3453-3455 of 2017, decided on 8-12-2017

1

Interest on warehoused goods - Limitation - Section 61(2) of Customs

Act, 1962 only referring to interest payable under Section 47 ibid and not to

Section 27 ibid - Even post amendment of Section 27 ibid in 1991, distinction

kept between duty and interest payable on such duty - There being no limita-

tion provided for refund of interest paid on warehoused goods, Tribunal order

based on C.B.E. & C. Instruction F. No. 475/39/90-Cus.VII, dated 8-8-1990 can-

not be faulted - Refund not time-barred - Admissible. [paras 7, 8]

Interest on warehoused goods - Warehousing period applicable would

be the period in force on the date of deposit of the goods in the warehouse, in

spite of further amendment brought in to reduce the warehousing period - Sec-

tion 61 of Customs Act, 1962. [paras 6, 8]

Appeals dismissed

CASES CITED

Commissioner v. Lakshmi Electrical Control Systems Ltd. — 2016 (336) E.L.T. 619 (Mad.)

— Relied on .................................................................................................................................. [Paras 7, 8]

Union of India v. Bangalore Wire Rod Mill — 1996 (83) E.L.T. 251 (S.C.) — Relied on ............. [Paras 6, 8]

DEPARTMENTAL CLARIFICATION CITED

C.B.E. & C. Instruction F. No. 475/39/90-Cus.VII, dated 8-8-1990 .............................................. [Paras 4, 7]

REPRESENTED BY : Shri A.P. Srinivas, for the Appellant.

[Judgment per : S. Manikumar, J. (Common)]. - Final Order Nos. 757 to

759 of 2008, dated 23-7-2008 [2008 (230) E.L.T. 183 (Tri.-Mumbai)], are impugned

in the instant Civil Miscellaneous Appeals.

2. Short facts leading to the instant Civil Miscellaneous Appeals are as

follows :-

________________________________________________________________________

1 On appeal from 2008 (230) E.L.T. 183 (Tribunal).

EXCISE LAW TIMES 15th July 2020 241