Page 239 - ELT_15th July 2020_Vol 373_Part 2

P. 239

2020 ] HINDUSTAN TIN WORKS LTD. v. UNION OF INDIA 221

different types of cases. TED refund is allowed where TED exemption is not

available.

5. The DGFT argued that by virtue of Circular No. 16 of 15-3-2013 the

provisions of FTP have been in existence. To clarify, it is stated that the policy

circular did not introduce any amendment or new provision. The DGFT states

that Chapter 6 of the FTP contains provisions to set up EOUs, import and export

by them as well as allied governing the provisions. Para 6.2(b) of FTP 2009-14

clearly provides that the goods procured by an EOU from Domestic Tariff Area

(DTA) shall be exempted from payment of duty. It is further strengthened by

para 6.11(c) (ii), which stipulates that the goods procured by an EOU from the

DTA would be exempted from payment of Central Excise Duty. It is therefore

reiterated that the petitioner could have taken the benefit under the FTP subject

to the conditions provided in the FTP/Handbook of Procedure (HBP). If HBP

provides for exemption from payment of TED, the concerned unit cannot there-

fore, on its own decide the duty claimed for refund.

6. As is evident from the above discussion, the refund of TED claim in

this case pertains to export and transaction prior to 15-3-2013. The crucial clarifi-

catory circular was issued on that day. Two applications made in respect of sales

to the EOUs (Vimal Agro Products Pvt. Ltd. and TATA Coffee Ltd.) covered var-

ious periods prior to 15-3-2013. This aspect is of significance and appears to have

completely lost sight off. The DGFT - as well as Central Excise Authorities have

not principally denied that the supplies were made to EOUs (Vimal Agro Prod-

ucts Pvt. Ltd. and TATA Coffee Ltd.). In these circumstances, the question is

what constitutes the entitlement of such unit that supplied the goods to Export

Oriented Units. This can be gained from the extracts of FTP, which are repro-

duced below :

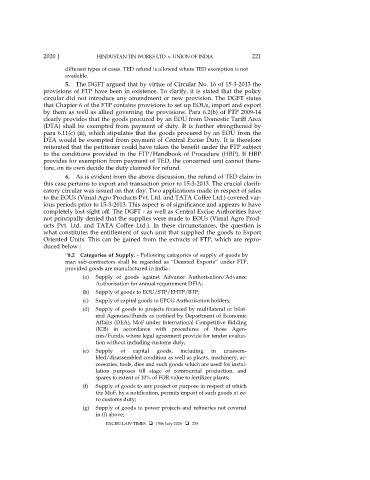

“8.2 Categories of Supply. - Following categories of supply of goods by

man sub-contractors shall be regarded as “Deemed Exports” under FTP,

provided goods are manufactured in India :

(a) Supply of goods against Advance Authorisation/Advance

Authorisation for annual requirement DFIA;

(b) Supply of goods to EOU/STP/EHTP/BTP;

(c) Supply of capital goods to EPCG Authorisation holders;

(d) Supply of goods to projects financed by multilateral or bilat-

eral Agencies/Funds as notified by Department of Economic

Affairs (DEA), MoF under International Competitive Bidding

(ICB) in accordance with procedures of those Agen-

cies/Funds, where legal agreement provide for tender evalua-

tion without including customs duty;

(e) Supply of capital goods, including in unassem-

bled/disassembled condition as well as plants, machinery, ac-

cessories, tools, dies and such goods which are used for instal-

lation purposes till stage of commercial production, and

spares to extent of 10% of FOR value to fertilizer plants;

(f) Supply of goods to any project or purpose in respect of which

the MoF, by a notification, permits import of such goods at ze-

ro customs duty;

(g) Supply of goods to power projects and refineries not covered

in (f) above;

EXCISE LAW TIMES 15th July 2020 239