Page 73 - ELT_15th July 2020_Vol 373_Part 2

P. 73

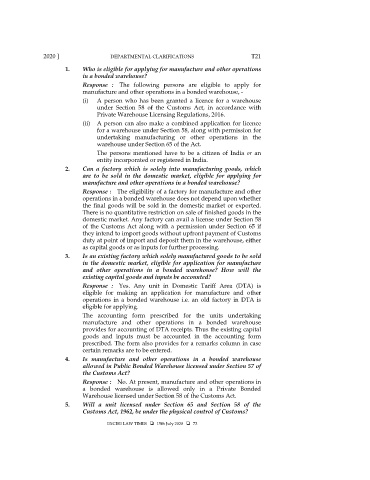

2020 ] DEPARTMENTAL CLARIFICATIONS T21

1. Who is eligible for applying for manufacture and other operations

in a bonded warehouse?

Response : The following persons are eligible to apply for

manufacture and other operations in a bonded warehouse, -

(i) A person who has been granted a licence for a warehouse

under Section 58 of the Customs Act, in accordance with

Private Warehouse Licensing Regulations, 2016.

(ii) A person can also make a combined application for licence

for a warehouse under Section 58, along with permission for

undertaking manufacturing or other operations in the

warehouse under Section 65 of the Act.

The persons mentioned have to be a citizen of India or an

entity incorporated or registered in India.

2. Can a factory which is solely into manufacturing goods, which

are to be sold in the domestic market, eligible for applying for

manufacture and other operations in a bonded warehouse?

Response : The eligibility of a factory for manufacture and other

operations in a bonded warehouse does not depend upon whether

the final goods will be sold in the domestic market or exported.

There is no quantitative restriction on sale of finished goods in the

domestic market. Any factory can avail a license under Section 58

of the Customs Act along with a permission under Section 65 if

they intend to import goods without upfront payment of Customs

duty at point of import and deposit them in the warehouse, either

as capital goods or as inputs for further processing.

3. Is an existing factory which solely manufactured goods to be sold

in the domestic market, eligible for application for manufacture

and other operations in a bonded warehouse? How will the

existing capital goods and inputs be accounted?

Response : Yes. Any unit in Domestic Tariff Area (DTA) is

eligible for making an application for manufacture and other

operations in a bonded warehouse i.e. an old factory in DTA is

eligible for applying.

The accounting form prescribed for the units undertaking

manufacture and other operations in a bonded warehouse

provides for accounting of DTA receipts. Thus the existing capital

goods and inputs must be accounted in the accounting form

prescribed. The form also provides for a remarks column in case

certain remarks are to be entered.

4. Is manufacture and other operations in a bonded warehouse

allowed in Public Bonded Warehouse licensed under Section 57 of

the Customs Act?

Response : No. At present, manufacture and other operations in

a bonded warehouse is allowed only in a Private Bonded

Warehouse licensed under Section 58 of the Customs Act.

5. Will a unit licensed under Section 65 and Section 58 of the

Customs Act, 1962, be under the physical control of Customs?

EXCISE LAW TIMES 15th July 2020 73