Page 71 - ELT_15th July 2020_Vol 373_Part 2

P. 71

2020 ] DEPARTMENTAL CLARIFICATIONS T19

I/We hereby declare that the contents of this shipping bill are true and

correct in every respect and are in accordance with the Airway Bills, the invoices

and other documents attached herewith.

Date : Signature and name of the Authorised Courier

with stamp of Authorised Courier

Place :

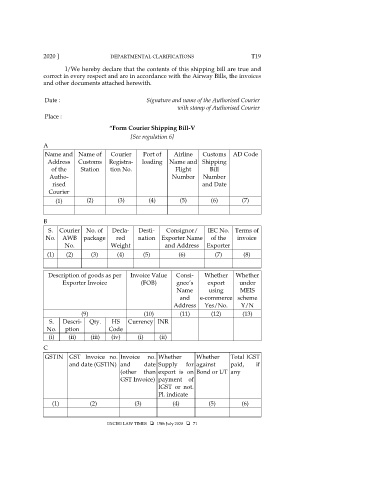

“Form Courier Shipping Bill-V

[See regulation 6]

A

Name and Name of Courier Port of Airline Customs AD Code

Address Customs Registra- loading Name and Shipping

of the Station tion No. Flight Bill

Autho- Number Number

rised and Date

Courier

(1) (2) (3) (4) (5) (6) (7)

B

S. Courier No. of Decla- Desti- Consignor/ IEC No. Terms of

No. AWB package red nation Exporter Name of the invoice

No. Weight and Address Exporter

(1) (2) (3) (4) (5) (6) (7) (8)

Description of goods as per Invoice Value Consi- Whether Whether

Exporter Invoice (FOB) gnee’s export under

Name using MEIS

and e-commerce scheme

Address Yes/No. Y/N

(9) (10) (11) (12) (13)

S. Descri- Qty. HS Currency INR

No. ption Code

(i) (ii) (iii) (iv) (i) (ii)

C

GSTIN GST Invoice no. Invoice no. Whether Whether Total IGST

and date (GSTIN) and date Supply for against paid, if

(other than export is on Bond or UT any

GST Invoice) payment of

IGST or not.

Pl. indicate

(1) (2) (3) (4) (5) (6)

EXCISE LAW TIMES 15th July 2020 71