Page 70 - ELT_15th July 2020_Vol 373_Part 2

P. 70

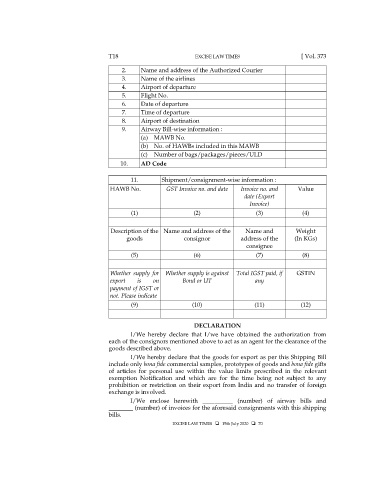

T18 EXCISE LAW TIMES [ Vol. 373

2. Name and address of the Authorized Courier

3. Name of the airlines

4. Airport of departure

5. Flight No.

6. Date of departure

7. Time of departure

8. Airport of destination

9. Airway Bill-wise information :

(a) MAWB No.

(b) No. of HAWBs included in this MAWB

(c) Number of bags/packages/pieces/ULD

10. AD Code

11. Shipment/consignment-wise information :

HAWB No. GST Invoice no. and date Invoice no. and Value

date (Export

Invoice)

(1) (2) (3) (4)

Description of the Name and address of the Name and Weight

goods consignor address of the (In KGs)

consignee

(5) (6) (7) (8)

Whether supply for Whether supply is against Total IGST paid, if GSTIN

export is on Bond or UT any

payment of IGST or

not. Please indicate

(9) (10) (11) (12)

DECLARATION

I/We hereby declare that I/we have obtained the authorization from

each of the consignors mentioned above to act as an agent for the clearance of the

goods described above.

I/We hereby declare that the goods for export as per this Shipping Bill

include only bona fide commercial samples, prototypes of goods and bona fide gifts

of articles for personal use within the value limits prescribed in the relevant

exemption Notification and which are for the time being not subject to any

prohibition or restriction on their export from India and no transfer of foreign

exchange is involved.

I/We enclose herewith __________ (number) of airway bills and

________ (number) of invoices for the aforesaid consignments with this shipping

bills.

EXCISE LAW TIMES 15th July 2020 70