Page 94 - ELT_15th July 2020_Vol 373_Part 2

P. 94

N26 EXCISE LAW TIMES [ Vol. 373

(1) (2) (3) (4)

gold findings, oth-

er than imports of

such goods

through post, cou-

rier or baggage.

Explanation. - For the

purposes of this entry,

“gold findings” means a

small component such

as hook, clasp, clamp,

pin, catch, screw back

used to hold the whole

or a part of a piece of

Jewellery in place.

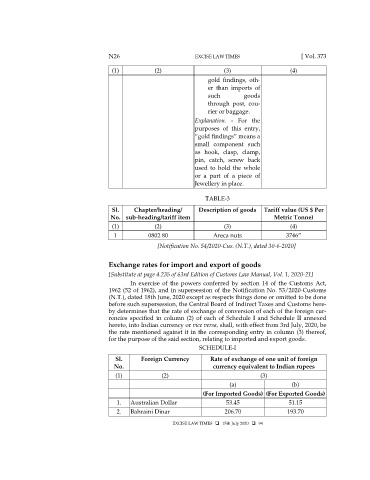

TABLE-3

Sl. Chapter/heading/ Description of goods Tariff value (US $ Per

No. sub-heading/tariff item Metric Tonne)

(1) (2) (3) (4)

1 0802 80 Areca nuts 3746”

[Notification No. 54/2020-Cus. (N.T.), dated 30-6-2020]

Exchange rates for import and export of goods

[Substitute at page 4.235 of 63rd Edition of Customs Law Manual, Vol. 1, 2020-21]

In exercise of the powers conferred by section 14 of the Customs Act,

1962 (52 of 1962), and in supersession of the Notification No. 53/2020-Customs

(N.T.), dated 18th June, 2020 except as respects things done or omitted to be done

before such supersession, the Central Board of Indirect Taxes and Customs here-

by determines that the rate of exchange of conversion of each of the foreign cur-

rencies specified in column (2) of each of Schedule I and Schedule II annexed

hereto, into Indian currency or vice versa, shall, with effect from 3rd July, 2020, be

the rate mentioned against it in the corresponding entry in column (3) thereof,

for the purpose of the said section, relating to imported and export goods.

SCHEDULE-I

Sl. Foreign Currency Rate of exchange of one unit of foreign

No. currency equivalent to Indian rupees

(1) (2) (3)

(a) (b)

(For Imported Goods) (For Exported Goods)

1. Australian Dollar 53.45 51.15

2. Bahraini Dinar 206.70 193.70

EXCISE LAW TIMES 15th July 2020 94