Page 97 - ELT_15th July 2020_Vol 373_Part 2

P. 97

2020 ] NOTIFICATIONS N29

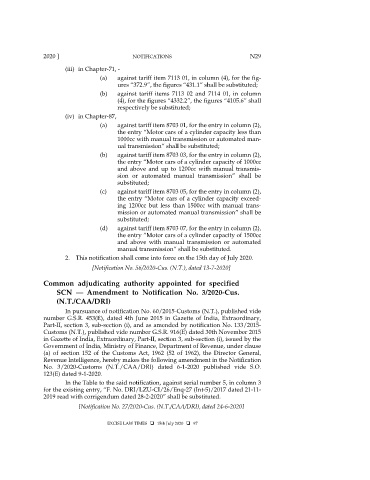

(iii) in Chapter-71, -

(a) against tariff item 7113 01, in column (4), for the fig-

ures “372.9”, the figures “431.1” shall be substituted;

(b) against tariff items 7113 02 and 7114 01, in column

(4), for the figures “4332.2”, the figures “4105.6” shall

respectively be substituted;

(iv) in Chapter-87,

(a) against tariff item 8703 01, for the entry in column (2),

the entry “Motor cars of a cylinder capacity less than

1000cc with manual transmission or automated man-

ual transmission” shall be substituted;

(b) against tariff item 8703 03, for the entry in column (2),

the entry “Motor cars of a cylinder capacity of 1000cc

and above and up to 1200cc with manual transmis-

sion or automated manual transmission” shall be

substituted;

(c) against tariff item 8703 05, for the entry in column (2),

the entry “Motor cars of a cylinder capacity exceed-

ing 1200cc but less than 1500cc with manual trans-

mission or automated manual transmission” shall be

substituted;

(d) against tariff item 8703 07, for the entry in column (2),

the entry “Motor cars of a cylinder capacity of 1500cc

and above with manual transmission or automated

manual transmission” shall be substituted.

2. This notification shall come into force on the 15th day of July 2020.

[Notification No. 56/2020-Cus. (N.T.), dated 13-7-2020]

Common adjudicating authority appointed for specified

SCN — Amendment to Notification No. 3/2020-Cus.

(N.T./CAA/DRI)

In pursuance of notification No. 60/2015-Customs (N.T.), published vide

number G.S.R. 453(E), dated 4th June 2015 in Gazette of India, Extraordinary,

Part-II, section 3, sub-section (i), and as amended by notification No. 133/2015-

Customs (N.T.), published vide number G.S.R. 916(E) dated 30th November 2015

in Gazette of India, Extraordinary, Part-II, section 3, sub-section (i), issued by the

Government of India, Ministry of Finance, Department of Revenue, under clause

(a) of section 152 of the Customs Act, 1962 (52 of 1962), the Director General,

Revenue Intelligence, hereby makes the following amendment in the Notification

No. 3/2020-Customs (N.T./CAA/DRI) dated 6-1-2020 published vide S.O.

123(E) dated 9-1-2020.

In the Table to the said notification, against serial number 5, in column 3

for the existing entry, “F. No. DRI/LZU-CI/26/Enq-27 (Int-5)/2017 dated 21-11-

2019 read with corrigendum dated 28-2-2020” shall be substituted.

[Notification No. 27/2020-Cus. (N.T./CAA/DRI), dated 24-6-2020]

EXCISE LAW TIMES 15th July 2020 97