Page 96 - ELT_15th July 2020_Vol 373_Part 2

P. 96

N28 EXCISE LAW TIMES [ Vol. 373

28th January 2020, published in the Gazette of India, Extraordinary, Part II, Sec-

tion 3, Sub-section (i) vide number G.S.R. 55(E), dated the 28th January 2020,

namely :-

In the said notification, in the Schedule, -

(i) in Chapter-29, -

(a) tariff item 2922 05 and the entries relating thereto shall be

omitted;

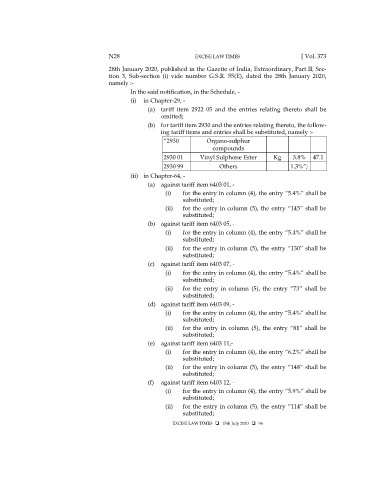

(b) for tariff item 2930 and the entries relating thereto, the follow-

ing tariff items and entries shall be substituted, namely :-

“2930 Organo-sulphur

compounds

2930 01 Vinyl Sulphone Ester Kg 3.8% 47.1

2930 99 Others 1.3%”;

(ii) in Chapter-64, -

(a) against tariff item 6403 01, -

(i) for the entry in column (4), the entry “5.4%” shall be

substituted;

(ii) for the entry in column (5), the entry “145” shall be

substituted;

(b) against tariff item 6403 05, -

(i) for the entry in column (4), the entry “5.4%” shall be

substituted;

(ii) for the entry in column (5), the entry “130” shall be

substituted;

(c) against tariff item 6403 07, -

(i) for the entry in column (4), the entry “5.4%” shall be

substituted;

(ii) for the entry in column (5), the entry “73” shall be

substituted;

(d) against tariff item 6403 09, -

(i) for the entry in column (4), the entry “5.4%” shall be

substituted;

(ii) for the entry in column (5), the entry “81” shall be

substituted;

(e) against tariff item 6403 11,-

(i) for the entry in column (4), the entry “6.2%” shall be

substituted;

(ii) for the entry in column (5), the entry “148” shall be

substituted;

(f) against tariff item 6403 12, -

(i) for the entry in column (4), the entry “5.9%” shall be

substituted;

(ii) for the entry in column (5), the entry “114” shall be

substituted;

EXCISE LAW TIMES 15th July 2020 96