Page 60 - ELT_15th August 2020_Vol 373_Part 4

P. 60

N48 EXCISE LAW TIMES [ Vol. 373

(iii) the injury to the domestic industry has been caused by the dumped

imports from subject country;

and has recommended imposition of provisional anti-dumping duty on

imports of the subject goods, originating in, or exported from subject country

and imported into India, in order to remove injury to the domestic industry.

Now, therefore, in exercise of the powers conferred by sub-section (2) of

section 9A of the Customs Tariff Act read with rules 13 and 20 of the Customs

Tariff (Identification, Assessment and Collection of Anti-dumping Duty on

Dumped Articles and for Determination of Injury) Rules, 1995, the Central Gov-

ernment, on the basis of the aforesaid findings of the designated authority, here-

by imposes on the subject goods, the description of which is specified in column

(3) of the Table below, falling under tariff item of the First Schedule to the said

Customs Tariff Act as specified in the corresponding entry in column (2), origi-

nating in the countries as specified in the corresponding entry in column (4), ex-

ported from the countries as specified in the corresponding entry in column (5),

produced by the producers as specified in the corresponding entry in column (6),

and imported into India, a provisional anti-dumping duty at the rate equal to the

amount as specified in the corresponding entry in column (7), in the currency as

specified in the corresponding entry in column (9) and as per unit of measure-

ment as specified in the corresponding entry in column (8) of the said Table,

namely :-

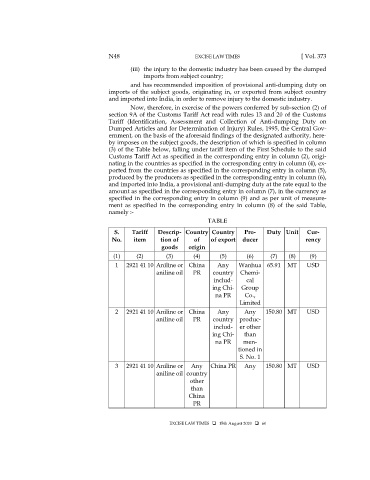

TABLE

S. Tariff Descrip- Country Country Pro- Duty Unit Cur-

No. item tion of of of export ducer rency

goods origin

(1) (2) (3) (4) (5) (6) (7) (8) (9)

1 2921 41 10 Aniline or China Any Wanhua 65.91 MT USD

aniline oil PR country Chemi-

includ- cal

ing Chi- Group

na PR Co.,

Limited

2 2921 41 10 Aniline or China Any Any 150.80 MT USD

aniline oil PR country produc-

includ- er other

ing Chi- than

na PR men-

tioned in

S. No. 1

3 2921 41 10 Aniline or Any China PR Any 150.80 MT USD

aniline oil country

other

than

China

PR

EXCISE LAW TIMES 15th August 2020 60