Page 62 - ELT_15th August 2020_Vol 373_Part 4

P. 62

N50 EXCISE LAW TIMES [ Vol. 373

(d) the injury has been caused by the dumped imports of the subject

goods from the subject countries,

and has recommended imposition of definitive anti-dumping duty on imports of

the subject goods, originating in, or exported from subject countries and import-

ed into India, in order to remove injury to the domestic industry.

Now, therefore, in exercise of the powers conferred by sub-sections (1)

and (5) of section 9A of the Customs Tariff Act, read with rules 18 and 20 of the

Customs Tariff (Identification, Assessment and Collection of Anti-dumping Duty

on Dumped Articles and for Determination of Injury) Rules, 1995, and in super-

session of the notification of the Government of India in the Ministry of Finance

(Department of Revenue), No. 2/2020-Customs (ADD), dated the 30th January,

2020, published vide number G.S.R 58(E), dated the 30th January, 2020, except as

respects things done or omitted to be done before such supersession, the Central

Government, after considering the aforesaid final findings of the designated au-

thority, hereby imposes on the subject goods, the description of which is speci-

fied in column (3) of the Table below, falling under sub-heading or tariff items of

the First Schedule to the Customs Tariff Act as specified in the corresponding

entry in column (2), originating in the countries as specified in the corresponding

entry in column (4), exported from the countries as specified in the correspond-

ing entry in column (5), produced by the producers as specified in the corre-

sponding entry in column (6), imported into India, an anti-dumping duty at the

rate equal to the amount specified in the corresponding entry in column (7), in

the currency as specified in the corresponding entry in column (9) and as per unit

of measurement as specified in the corresponding entry in column (8) of the said

Table, namely :-

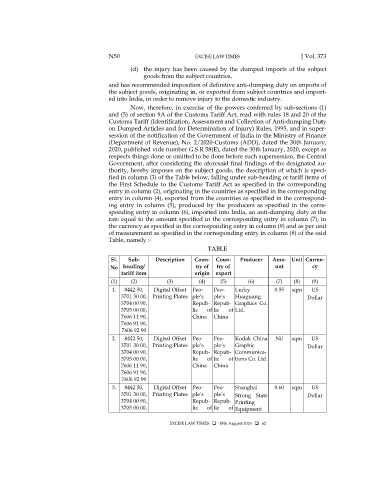

TABLE

Sl. Sub- Description Coun- Coun- Producer Amo- Unit Curren-

No heading/ try of try of unt cy

tariff item origin export

(1) (2) (3) (4) (5) (6) (7) (8) (9)

1. 8442 50, Digital Offset Peo- Peo- Lucky 0.55 sqm US

3701 30 00, Printing Plates ple’s ple’s Huaguang Dollar

3704 00 90, Repub- Repub- Graphics Co.

3705 00 00, lic of lic of Ltd.

7606 11 90, China China

7606 91 90,

7606 92 90

2. 8442 50, Digital Offset Peo- Peo- Kodak China Nil sqm US

3701 30 00, Printing Plates ple’s ple’s Graphic Dollar

3704 00 90, Repub- Repub- Communica-

3705 00 00, lic of lic of tions Co. Ltd.

7606 11 90, China China

7606 91 90,

7606 92 90

3. 8442 50, Digital Offset Peo- Peo- Shanghai 0.60 sqm US

3701 30 00, Printing Plates ple’s ple’s Strong State Dollar

3704 00 90, Repub- Repub- Printing

3705 00 00, lic of lic of Equipment

EXCISE LAW TIMES 15th August 2020 62