Page 119 - GSTL_14th May 2020_Vol 36_Part 2

P. 119

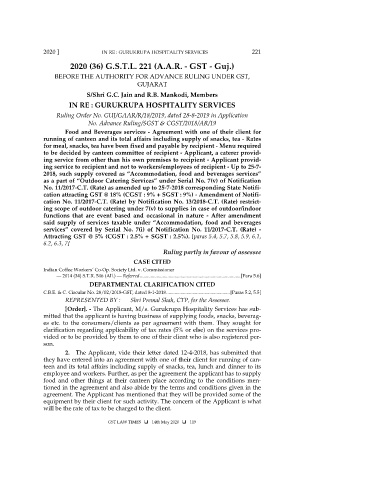

2020 ] IN RE : GURUKRUPA HOSPITALITY SERVICES 221

2020 (36) G.S.T.L. 221 (A.A.R. - GST - Guj.)

BEFORE THE AUTHORITY FOR ADVANCE RULING UNDER GST,

GUJARAT

S/Shri G.C. Jain and R.B. Mankodi, Members

IN RE : GURUKRUPA HOSPITALITY SERVICES

Ruling Order No. GUJ/GAAR/R/18/2019, dated 28-8-2019 in Application

No. Advance Ruling/SGST & CGST/2018/AR/19

Food and Beverages services - Agreement with one of their client for

running of canteen and its total affairs including supply of snacks, tea - Rates

for meal, snacks, tea have been fixed and payable by recipient - Menu required

to be decided by canteen committee of recipient - Applicant, a caterer provid-

ing service from other than his own premises to recipient - Applicant provid-

ing service to recipient and not to workers/employees of recipient - Up to 25-7-

2018, such supply covered as “Accommodation, food and beverages services”

as a part of “Outdoor Catering Services” under Serial No. 7(v) of Notification

No. 11/2017-C.T. (Rate) as amended up to 25-7-2018 corresponding State Notifi-

cation attracting GST @ 18% (CGST : 9% + SGST : 9%) - Amendment of Notifi-

cation No. 11/2017-C.T. (Rate) by Notification No. 13/2018-C.T. (Rate) restrict-

ing scope of outdoor catering under 7(v) to supplies in case of outdoor/indoor

functions that are event based and occasional in nature - After amendment

said supply of services taxable under “Accommodation, food and beverages

services” covered by Serial No. 7(i) of Notification No. 11/2017-C.T. (Rate) -

Attracting GST @ 5% (CGST : 2.5% + SGST : 2.5%). [paras 5.4, 5.7, 5.8, 5.9, 6.1,

6.2, 6.3, 7]

Ruling partly in favour of assessee

CASE CITED

Indian Coffee Workers’ Co-Op. Society Ltd. v. Commissioner

— 2014 (34) S.T.R. 546 (All.) — Referred .................................................................................... [Para 5.6]

DEPARTMENTAL CLARIFICATION CITED

C.B.E. & C. Circular No. 28/02/2018-GST, dated 8-1-2018 ..................................................... [Paras 5.2, 5.5]

REPRESENTED BY : Shri Premal Shah, CTP, for the Assessee.

[Order]. - The Applicant, M/s. Gurukrupa Hospitality Services has sub-

mitted that the applicant is having business of supplying foods, snacks, beverag-

es etc. to the consumers/clients as per agreement with them. They sought for

clarification regarding applicability of tax rates (5% or else) on the services pro-

vided or to be provided by them to one of their client who is also registered per-

son.

2. The Applicant, vide their letter dated 12-4-2018, has submitted that

they have entered into an agreement with one of their client for running of can-

teen and its total affairs including supply of snacks, tea, lunch and dinner to its

employee and workers. Further, as per the agreement the applicant has to supply

food and other things at their canteen place according to the conditions men-

tioned in the agreement and also abide by the terms and conditions given in the

agreement. The Applicant has mentioned that they will be provided some of the

equipment by their client for such activity. The concern of the Applicant is what

will be the rate of tax to be charged to the client.

GST LAW TIMES 14th May 2020 119