Page 135 - GSTL_14th May 2020_Vol 36_Part 2

P. 135

2020 ] IN RE : PRAYAGRAJ DYEING & PRINTING MILLS PVT. LTD. 237

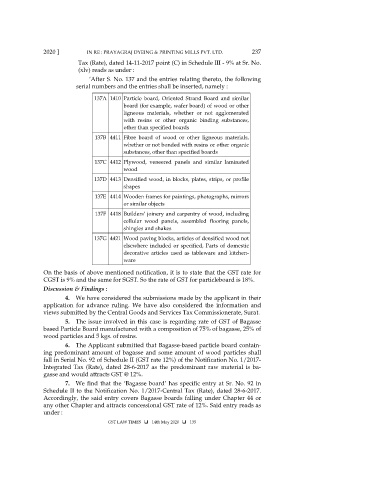

Tax (Rate), dated 14-11-2017 point (C) in Schedule III - 9% at Sr. No.

(xlv) reads as under :

‘After S. No. 137 and the entries relating thereto, the following

serial numbers and the entries shall be inserted, namely :

137A 1410 Particle board, Oriented Strand Board and similar

board (for example, wafer board) of wood or other

ligneous materials, whether or not agglomerated

with resins or other organic binding substances,

other than specified boards

137B 4411 Fibre board of wood or other ligneous materials,

whether or not bonded with resins or other organic

substances, other than specified boards

137C 4412 Plywood, veneered panels and similar laminated

wood

137D 4413 Densified wood, in blocks, plates, strips, or profile

shapes

137E 4414 Wooden frames for paintings, photographs, mirrors

or similar objects

137F 4418 Builders’ joinery and carpentry of wood, including

cellular wood panels, assembled flooring panels,

shingles and shakes

137G 4421 Wood paving blocks, articles of densified wood not

elsewhere included or specified, Parts of domestic

decorative articles used as tableware and kitchen-

ware

On the basis of above mentioned notification, it is to state that the GST rate for

CGST is 9% and the same for SGST. So the rate of GST for particleboard is 18%.

Discussion & Findings :

4. We have considered the submissions made by the applicant in their

application for advance ruling. We have also considered the information and

views submitted by the Central Goods and Services Tax Commissionerate, Surat.

5. The issue involved in this case is regarding rate of GST of Bagasse

based Particle Board manufactured with a composition of 75% of bagasse, 25% of

wood particles and 5 kgs. of resins.

6. The Applicant submitted that Bagasse-based particle board contain-

ing predominant amount of bagasse and some amount of wood particles shall

fall in Serial No. 92 of Schedule II (GST rate 12%) of the Notification No. 1/2017-

Integrated Tax (Rate), dated 28-6-2017 as the predominant raw material is ba-

gasse and would attracts GST @ 12%.

7. We find that the ‘Bagasse board’ has specific entry at Sr. No. 92 in

Schedule II to the Notification No. 1/2017-Central Tax (Rate), dated 28-6-2017.

Accordingly, the said entry covers Bagasse boards falling under Chapter 44 or

any other Chapter and attracts concessional GST rate of 12%. Said entry reads as

under :

GST LAW TIMES 14th May 2020 135