Page 69 - GSTL_14th May 2020_Vol 36_Part 2

P. 69

2020 ] MRF LTD. v. STATE OF KERALA 171

event, the authorities felt any assessee or dealer was taking unintended benefit

under the aforesaid provisions of the 1956 Act, then the proper course would be

legislative amendment. The Tax Administration Authorities cannot give their

own interpretation to legislative provisions on the basis of their own perception

of trade practise. This administrative exercise, in effect, would result in supply-

ing words to legislative provisions, as if to cure omissions of the legislature.

16. For these reasons, we do not want to interfere with the judgments

of the High Court in these four appeals. The appeals are dismissed. Any connect-

ed applications shall also stand disposed of.

17. There shall be no order as to costs.

_______

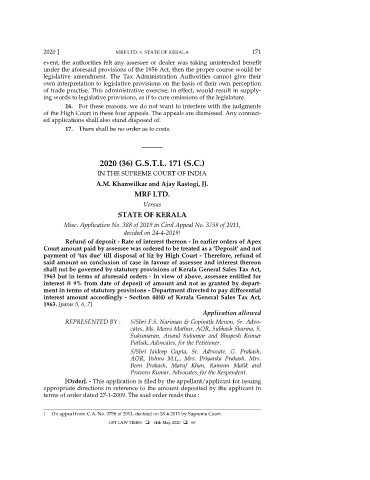

2020 (36) G.S.T.L. 171 (S.C.)

IN THE SUPREME COURT OF INDIA

A.M. Khanwilkar and Ajay Rastogi, JJ.

MRF LTD.

Versus

STATE OF KERALA

Misc. Application No. 388 of 2019 in Civil Appeal No. 3758 of 2011,

1

decided on 24-4-2019

Refund of deposit - Rate of interest thereon - In earlier orders of Apex

Court amount paid by assessee was ordered to be treated as a ‘Deposit’ and not

payment of ‘tax due’ till disposal of liz by High Court - Therefore, refund of

said amount on conclusion of case in favour of assessee and interest thereon

shall not be governed by statutory provisions of Kerala General Sales Tax Act,

1963 but in terms of aforesaid orders - In view of above, assessee entitled for

interest @ 9% from date of deposit of amount and not as granted by depart-

ment in terms of statutory provisions - Department directed to pay differential

interest amount accordingly - Section 44(4) of Kerala General Sales Tax Act,

1963. [paras 5, 6, 7]

Application allowed

REPRESENTED BY : S/Shri F.S. Nariman & Gopinath Menon, Sr. Advo-

cates, Ms. Meera Mathur, AOR, Subhash Sharma, S.

Sukumaran, Anand Sukumar and Bhupesh Kumar

Pathak, Advocates, for the Petitioner.

S/Shri Jaideep Gupta, Sr. Advocate, G. Prakash,

AOR, Jishnu M.L., Mrs. Priyanka Prakash, Mrs.

Been Prakash, Maruf Khan, Kamran Malik and

Praveen Kumar, Advocates, for the Respondent.

[Order]. - This application is filed by the appellant/applicant for issuing

appropriate directions in reference to the amount deposited by the applicant in

terms of order dated 27-1-2009. The said order reads thus :

________________________________________________________________________

1 On appeal from C.A. No. 3758 of 2011, decided on 28-4-2011 by Supreme Court.

GST LAW TIMES 14th May 2020 69