Page 71 - GSTL_14th May 2020_Vol 36_Part 2

P. 71

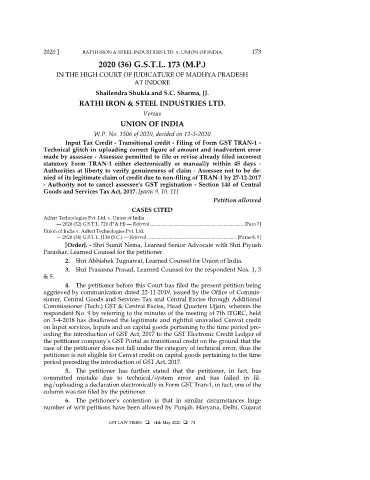

2020 ] RATHI IRON & STEEL INDUSTRIES LTD. v. UNION OF INDIA 173

2020 (36) G.S.T.L. 173 (M.P.)

IN THE HIGH COURT OF JUDICATURE OF MADHYA PRADESH

AT INDORE

Shailendra Shukla and S.C. Sharma, JJ.

RATHI IRON & STEEL INDUSTRIES LTD.

Versus

UNION OF INDIA

W.P. No. 1506 of 2020, decided on 12-3-2020

Input Tax Credit - Transitional credit - Filing of Form GST TRAN-1 -

Technical glitch in uploading correct figure of amount and inadvertent error

made by assessee - Assessee permitted to file or revise already filed incorrect

statutory Form TRAN-1 either electronically or manually within 45 days -

Authorities at liberty to verify genuineness of claim - Assessee not to be de-

nied of its legitimate claim of credit due to non-filing of TRAN-1 by 27-12-2017

- Authority not to cancel assessee’s GST registration - Section 140 of Central

Goods and Services Tax Act, 2017. [paras 9, 10, 11]

Petition allowed

CASES CITED

Adfert Technologies Pvt. Ltd. v. Union of India

— 2020 (32) G.S.T.L. 726 (P & H) — Referred ............................................................................... [Para 7]

Union of India v. Adfert Technologies Pvt. Ltd.

— 2020 (34) G.S.T.L. J138 (S.C.) — Referred ........................................................................... [Paras 8, 9]

[Order]. - Shri Sumit Nema, Learned Senior Advocate with Shri Piyush

Parashar, Learned Counsel for the petitioner.

2. Shri Abhishek Tugnawat, Learned Counsel for Union of India.

3. Shri Prasanna Prasad, Learned Counsel for the respondent Nos. 1, 3

& 5.

4. The petitioner before this Court has filed the present petition being

aggrieved by communication dated 22-11-2019, issued by the Office of Commis-

sioner, Central Goods and Services Tax and Central Excise through Additional

Commissioner (Tech.) GST & Central Excise, Head Quarters Ujjain, wherein the

respondent No. 9 by referring to the minutes of the meeting of 7th ITGRC, held

on 3-4-2018 has disallowed the legitimate and rightful unavailed Cenvat credit

on Input services, Inputs and on capital goods pertaining to the time period pre-

ceding the introduction of GST Act, 2017 to the GST Electronic Credit Ledger of

the petitioner company’s GST Portal as transitional credit on the ground that the

case of the petitioner does not fall under the category of technical error, thus the

petitioner is not eligible for Cenvat credit on capital goods pertaining to the time

period preceding the introduction of GST Act, 2017.

5. The petitioner has further stated that the petitioner, in fact, has

committed mistake due to technical/system error and has failed in fil-

ing/uploading a declaration electronically in Form GST Tran-1, in fact, one of the

column was not filed by the petitioner.

6. The petitioner’s contention is that in similar circumstances large

number of writ petitions have been allowed by Punjab, Haryana, Delhi, Gujarat

GST LAW TIMES 14th May 2020 71