Page 15 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 15

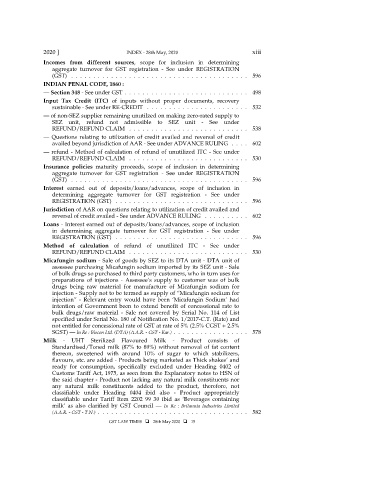

2020 ] INDEX - 28th May, 2020 xiii

Incomes from different sources, scope for inclusion in determining

aggregate turnover for GST registration - See under REGISTRATION

(GST) ........................................ 596

INDIAN PENAL CODE, 1860 :

— Section 348 - See under GST ............................ 498

Input Tax Credit (ITC) of inputs without proper documents, recovery

sustainable - See under RE-CREDIT ....................... 532

— of non-SEZ supplier remaining unutilzed on making zero-rated supply to

SEZ unit, refund not admissible to SEZ unit - See under

REFUND/REFUND CLAIM ........................... 538

— Questions relating to utilization of credit availed and reversal of credit

availed beyond jurisdiction of AAR - See under ADVANCE RULING .... 602

— refund - Method of calculation of refund of unutilized ITC - See under

REFUND/REFUND CLAIM ........................... 530

Insurance policies maturity proceeds, scope of inclusion in determining

aggregate turnover for GST registration - See under REGISTRATION

(GST) ........................................ 596

Interest earned out of deposits/loans/advances, scope of inclusion in

determining aggregate turnover for GST registration - See under

REGISTRATION (GST) .............................. 596

Jurisdiction of AAR on questions relating to utilization of credit availed and

reversal of credit availed - See under ADVANCE RULING .......... 602

Loans - Interest earned out of deposits/loans/advances, scope of inclusion

in determining aggregate turnover for GST registration - See under

REGISTRATION (GST) .............................. 596

Method of calculation of refund of unutilized ITC - See under

REFUND/REFUND CLAIM ........................... 530

Micafungin sodium - Sale of goods by SEZ to its DTA unit - DTA unit of

assessee purchasing Micafungin sodium imported by its SEZ unit - Sale

of bulk drugs so purchased to third party customers, who in turn uses for

preparations of injections - Assessee’s supply to customer was of bulk

drugs being raw material for manufacture of Micafungin sodium for

injection - Supply not to be termed as supply of “Micafungin sodium for

injection” - Relevant entry would have been ‘Micafungin Sodium’ had

intention of Government been to extend benefit of concessional rate to

bulk drugs/raw material - Sale not covered by Serial No. 114 of List

specified under Serial No. 180 of Notification No. 1/2017-C.T. (Rate) and

not entitled for concessional rate of GST at rate of 5% (2.5% CGST + 2.5%

SGST) — In Re : Biocon Ltd. (DTA) (A.A.R. - GST - Kar.) ................. 578

Milk - UHT Sterilized Flavoured Milk - Product consists of

Standardised/Toned milk (87% to 89%) without removal of fat content

thereon, sweetened with around 10% of sugar to which stabilizers,

flavours, etc. are added - Products being marketed as Thick shakes’ and

ready for consumption, specifically excluded under Heading 0402 of

Customs Tariff Act, 1975, as seen from the Explanatory notes to HSN of

the said chapter - Product not lacking any natural milk constituents nor

any natural milk constituents added to the product, therefore, not

classifiable under Heading 0404 ibid also - Product appropriately

classifiable under Tariff Item 2202 99 30 ibid as ‘Beverages containing

milk’ as also clarified by GST Council — In Re : Britannia Industries Limited

(A.A.R. - GST - T.N.) .................................. 582

GST LAW TIMES 28th May 2020 15