Page 16 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 16

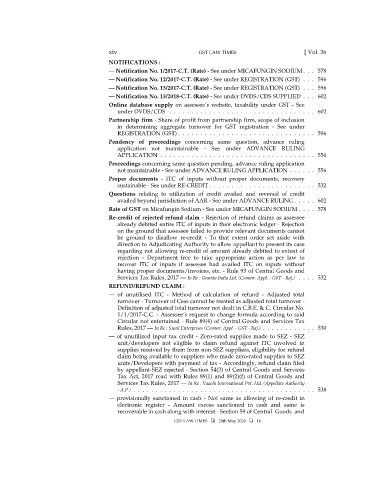

xiv GST LAW TIMES [ Vol. 36

NOTIFICATIONS :

— Notification No. 1/2017-C.T. (Rate) - See under MICAFUNGIN SODIUM ... 578

— Notification No. 12/2017-C.T. (Rate) - See under REGISTRATION (GST) ... 596

— Notification No. 13/2017-C.T. (Rate) - See under REGISTRATION (GST) ... 596

— Notification No. 13/2018-C.T. (Rate) - See under DVDS/CDS SUPPLIED ... 602

Online database supply on assessee’s website, taxability under GST - See

under DVDS/CDS ................................. 602

Partnership firm - Share of profit from partnership firm, scope of inclusion

in determining aggregate turnover for GST registration - See under

REGISTRATION (GST) ............................... 596

Pendency of proceedings concerning same question, advance ruling

application not maintainable - See under ADVANCE RULING

APPLICATION ................................... 556

Proceedings concerning same question pending, advance ruling application

not maintainable - See under ADVANCE RULING APPLICATION ...... 556

Proper documents - ITC of inputs without proper documents, recovery

sustainable - See under RE-CREDIT ........................ 532

Questions relating to utilization of credit availed and reversal of credit

availed beyond jurisdiction of AAR - See under ADVANCE RULING ..... 602

Rate of GST on Micafungin Sodium - See under MICAFUNGIN SODIUM .... 578

Re-credit of rejected refund claim - Rejection of refund claims as assessee

already debited entire ITC of inputs in their electronic ledger - Rejection

on the ground that assessee failed to provide relevant documents cannot

be ground to disallow re-credit - To that extent order set aside with

direction to Adjudicating Authority to allow appellant to present its case

regarding not allowing re-credit of amount already debited to extent of

rejection - Department free to take appropriate action as per law to

recover ITC of inputs if assessee had availed ITC on inputs without

having proper documents/invoices, etc. - Rule 93 of Central Goods and

Services Tax Rules, 2017 — In Re : Gravita India Ltd. (Commr. Appl. - GST - Raj.) .... 532

REFUND/REFUND CLAIM :

— of unutilised ITC - Method of calculation of refund - Adjusted total

turnover - Turnover of Cess cannot be treated as adjusted total turnover -

Definition of adjusted total turnover not dealt in C.B.E. & C. Circular No.

1/1/2017-C.C. - Assessee’s request to change formula according to said

Circular not entertained - Rule 89(4) of Central Goods and Services Tax

Rules, 2017 — In Re : Sunil Enterprises (Commr. Appl. - GST - Raj.) ............ 530

— of unutilized input tax credit - Zero-rated supplies made to SEZ - SEZ

unit/developers not eligible to claim refund against ITC involved in

supplies received by them from non-SEZ suppliers, eligibility for refund

claim being available to suppliers who made zero-rated supplies to SEZ

units/Developers with payment of tax - Accordingly, refund claim filed

by appellant-SEZ rejected - Section 54(3) of Central Goods and Services

Tax Act, 2017 read with Rules 89(1) and 89(2)(f) of Central Goods and

Services Tax Rules, 2017 — In Re : Vaachi International Pvt. Ltd. (Appellate Authority

- A.P.) ......................................... 538

— provisionally sanctioned in cash - Not same as allowing of re-credit in

electronic register - Amount excess sanctioned in cash and same is

recoverable in cash along with interest - Section 59 of Central Goods and

GST LAW TIMES 28th May 2020 16