Page 92 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 92

538 GST LAW TIMES [ Vol. 36

2020 (36) G.S.T.L. 538 (Appellate Authority - A.P.)

BEFORE THE APPELLATE AUTHORITY UNDER GST,

ANDHRA PRADESH

Smt. P. Vaishnavi, Joint Commissioner (ST) & Appellate Authority (ST)

IN RE : VAACHI INTERNATIONAL PVT. LTD.

Order No. 4990/2020, dated 10-2-2020 in Appeal No. APL1900232

Refund of unutilized input tax credit - Zero-rated supplies made to

SEZ - SEZ unit/developers not eligible to claim refund against ITC involved in

supplies received by them from non-SEZ suppliers, eligibility for refund claim

being available to suppliers who made zero-rated supplies to SEZ

units/Developers with payment of tax - Accordingly, refund claim filed by ap-

pellant-SEZ rejected - Section 54(3) of Central Goods and Services Tax Act,

2017 read with Rules 89(1) and 89(2)(f) of Central Goods and Services Tax

Rules, 2017. [para 21]

Appeal dismissed

[Order]. - This is an appeal filed by M/s. Vaachi International Pvt. Ltd.,

Trading Unit No. 3/8, VSEZ, Duvvada, Visakhapatnam (hereinafter referred to

as ‘Appellant’) against the tax orders passed by the Assistant Commissioner (ST),

Gajuwaka Circle, Visakhapatnam Division (hereinafter referred to as ‘Assessing

Authority’/for short ‘A.A.’) for the tax periods from July, 2017 to March, 2018

under CGST/APGST Act, 2017 in GSTIN : 37AABCV5897L1ZH vide his orders

dated 2-5-2019, disputing the rejection of refund of Rs. 20,97,104/-.

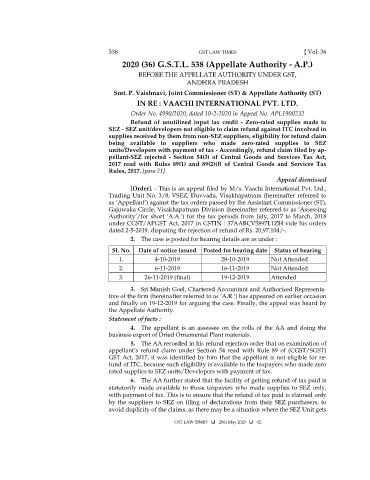

2. The case is posted for hearing details are as under :

Sl. No. Date of notice issued Posted for hearing date Status of hearing

1. 4-10-2019 28-10-2019 Not Attended

2. 6-11-2019 16-11-2019 Not Attended

3. 26-11-2019 (final) 19-12-2019 Attended

3. Sri Manish Goel, Chartered Accountant and Authorized Representa-

tive of the firm (hereinafter referred to as ‘A.R.’) has appeared on earlier occasion

and finally on 19-12-2019 for arguing the case. Finally, the appeal was heard by

the Appellate Authority.

Statement of facts :

4. The appellant is an assessee on the rolls of the AA and doing the

business export of Dried Ornamental Plant materials.

5. The AA recorded in his refund rejection order that on examination of

appellant’s refund claim under Section 54 read with Rule 89 of (CGST/SGST)

GST Act, 2017, it was identified by him that the appellant is not eligible for re-

fund of ITC, because such eligibility is available to the taxpayers who made zero

rated supplies to SEZ units/Developers with payment of tax.

6. The AA further stated that the facility of getting refund of tax paid is

statutorily made available to those taxpayers who made supplies to SEZ only,

with payment of tax. This is to ensure that the refund of tax paid is claimed only

by the suppliers to SEZ on filing of declarations from their SEZ purchasers, to

avoid duplicity of the claims, as there may be a situation where the SEZ Unit gets

GST LAW TIMES 28th May 2020 92