Page 87 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 87

2020 ] IN RE : GRAVITA INDIA LTD. 533

recoverable in cash along with interest - Section 59 of Central Goods and Ser-

vices Tax Act, 2017 - Rule 89 of Central Goods and Services Tax Rules, 2017.

[para 14]

Appeals disposed of

DEPARTMENTAL CLARIFICATION CITED

C.B.E. & C. Circular No. 17/17/2017-GST, dated 15-11-2017 ............................. [Paras 6.1, 7, 8, 9, 10.1, 12]

[Order]. - These six appeals have been filed before the appellate authori-

ty under Section 107 of the Central Goods and Services Tax Act, 2017 by M/s.

Gravita India Ltd., “Saurabh”, Chittora Road, Harsuliya Mod, Diggi-Malpura

Road, Tehsil-Phagi, Jaipur (Hereinafter also referred to as “the appellant”)

against the Orders-in-Original (Hereinafter called as the “impugned orders”)

passed by the Deputy Commissioner, Central Goods & Services Tax Division-F.

Jaipur (Hereinafter called as the “adjudication authority”) as mentioned below :-

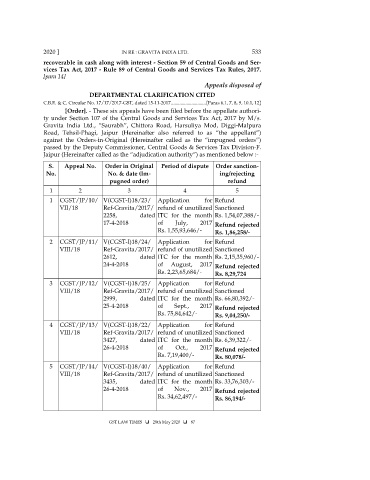

S. Appeal No. Order in Original Period of dispute Order sanction-

No. No. & date (Im- ing/rejecting

pugned order) refund

1 2 3 4 5

1 CGST/JP/10/ V(CGST-I)18/23/ Application for Refund

VII/18 Ref-Gravita/2017/ refund of unutilized Sanctioned

2258, dated ITC for the month Rs. 1,54,07,388/-

17-4-2018 of July, 2017 Refund rejected

Rs. 1,55,93,646/- Rs. 1,86,258/-

2 CGST/JP/11/ V(CGST-I)18/24/ Application for Refund

VIII/18 Ref-Gravita/2017/ refund of unutilized Sanctioned

2612, dated ITC for the month Rs. 2,15,35,960/-

24-4-2018 of August, 2017 Refund rejected

Rs. 2,23,65,684/- Rs. 8,29,724

3 CGST/JP/12/ V(CGST-I)18/25/ Application for Refund

VIII/18 Ref-Gravita/2017/ refund of unutilized Sanctioned

2999, dated ITC for the month Rs. 66,80,392/-

25-4-2018 of Sept., 2017 Refund rejected

Rs. 75,84,642/- Rs. 9,04,250/-

4 CGST/JP/13/ V(CGST-I)18/22/ Application for Refund

VIII/18 Ref-Gravita/2017/ refund of unutilized Sanctioned

3427, dated ITC for the month Rs. 6,39,322/-

26-4-2018 of Oct., 2017 Refund rejected

Rs. 7,19,400/- Rs. 80,078/-

5 CGST/JP/14/ V(CGST-I)18/40/ Application for Refund

VIII/18 Ref-Gravita/2017/ refund of unutilized Sanctioned

3435, dated ITC for the month Rs. 33,76,303/-

26-4-2018 of Nov., 2017 Refund rejected

Rs. 34,62,497/- Rs. 86,194/-

GST LAW TIMES 28th May 2020 87