Page 88 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 88

534 GST LAW TIMES [ Vol. 36

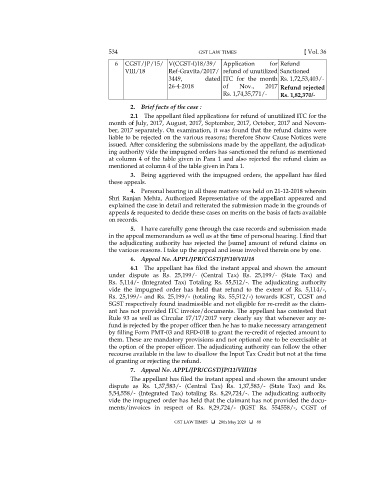

6 CGST/JP/15/ V(CGST-I)18/39/ Application for Refund

VIII/18 Ref-Gravita/2017/ refund of unutilized Sanctioned

3449, dated ITC for the month Rs. 1,72,53,403/-

26-4-2018 of Nov., 2017 Refund rejected

Rs. 1,74,35,771/- Rs. 1,82,370/-

2. Brief facts of the case :

2.1 The appellant filed applications for refund of unutilized ITC for the

month of July, 2017, August, 2017, September, 2017, October, 2017 and Novem-

ber, 2017 separately. On examination, it was found that the refund claims were

liable to be rejected on the various reasons; therefore Show Cause Notices were

issued. After considering the submissions made by the appellant, the adjudicat-

ing authority vide the impugned orders has sanctioned the refund as mentioned

at column 4 of the table given in Para 1 and also rejected the refund claim as

mentioned at column 4 of the table given in Para 1.

3. Being aggrieved with the impugned orders, the appellant has filed

these appeals.

4. Personal hearing in all these matters was held on 21-12-2018 wherein

Shri Ranjan Mehta, Authorized Representative of the appellant appeared and

explained the case in detail and reiterated the submission made in the grounds of

appeals & requested to decide these cases on merits on the basis of facts available

on records.

5. I have carefully gone through the case records and submission made

in the appeal memorandum as well as at the time of personal hearing. I find that

the adjudicating authority has rejected the [same] amount of refund claims on

the various reasons. I take up the appeal and issue involved therein one by one.

6. Appeal No. APPL/JPR/CGST/JP/10/VII/18

6.1 The appellant has filed the instant appeal and shown the amount

under dispute as Rs. 25,199/- (Central Tax) Rs. 25,199/- (State Tax) and

Rs. 5,114/- (Integrated Tax) Totaling Rs. 55,512/-. The adjudicating authority

vide the impugned order has held that refund to the extent of Rs. 5,114/-,

Rs. 25,199/- and Rs. 25,199/- (totaling Rs. 55,512/-) towards IGST, CGST and

SGST respectively found inadmissible and not eligible for re-credit as the claim-

ant has not provided ITC invoice/documents. The appellant has contested that

Rule 93 as well as Circular 17/17/2017 very clearly say that whenever any re-

fund is rejected by the proper officer then he has to make necessary arrangement

by filling Form PMT-03 and RFD-01B to grant the re-credit of rejected amount to

them. These are mandatory provisions and not optional one to be exercisable at

the option of the proper officer. The adjudicating authority can follow the other

recourse available in the law to disallow the Input Tax Credit but not at the time

of granting or rejecting the refund.

7. Appeal No. APPL/JPR/CGST/JP/11/VIII/18

The appellant has filed the instant appeal and shown the amount under

dispute as Rs. 1,37,583/- (Central Tax) Rs. 1,37,583/- (State Tax) and Rs.

5,54,558/- (Integrated Tax) totaling Rs. 8,29,724/-. The adjudicating authority

vide the impugned order has held that the claimant has not provided the docu-

ments/invoices in respect of Rs. 8,29,724/- (IGST Rs. 554558/-, CGST of

GST LAW TIMES 28th May 2020 88