Page 84 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 84

530 GST LAW TIMES [ Vol. 36

2020 (36) G.S.T.L. 530 (Commr. Appl. - GST - Raj.)

BEFORE THE COMMISSIONER OF GST (APPEALS), JAIPUR

Shri J.P. Meena, Additional Commissioner (Appeals)

IN RE : SUNIL ENTERPRISES

Order-in-Appeal Nos. 11 & 12 (JPM) CGST/JPR/2020, dated 13-1-2020 in

Application C. Nos. APPL/JPR/CGST/JP/31/X/18 & APPL/JPR/CGST/JP/30/X/18

Refund of unutilised ITC - Method of calculation of refund - Adjusted

total turnover - Turnover of Cess cannot be treated as adjusted total turnover -

Definition of adjusted total turnover not dealt in C.B.E. & C. Circular No.

1/1/2017-C.C., dated 26-7-2017 - Assessee’s request to change formula according

to said Circular not entertained - Rule 89(4) of Central Goods and Services Tax

Rules, 2017. [para 6]

Departmental instructions - C.B.I. & C. Circulars - Rules have overrid-

ing effect over Circular. [para 6]

Appeals rejected

DEPARTMENTAL CLARIFICATION CITED

C.B.E. & C. Circular No. 1/1/2017-C.C., dated 26-7-2017. ............................................................ [Paras 3, 6]

[Order]. - These two appeals have been filed before the appellate author-

ity under Section 107 of the Central Goods and Services Tax Act, 2017 by M/s.

Sunil Enterprises, B-40, Anupama Mension-II, M.I. Road, Jaipur (Hereinafter also

referred to as “the appellant”) against the Orders-in-Original (Hereinafter called

as the “impugned orders”) passed by the Assistant Commissioner, Central

Goods & Services Tax Division-H, Jaipur (Hereinafter called as the “adjudication

authority”) as mentioned below :-

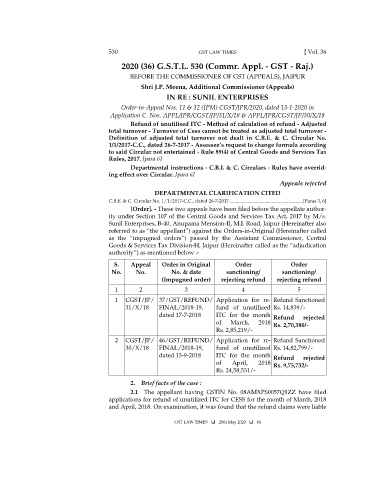

S. Appeal Order in Original Order Order

No. No. No. & date sanctioning/ sanctioning/

(Impugned order) rejecting refund rejecting refund

1 2 3 4 5

1 CGST/JP/ 37/GST/REFUND/ Application for re- Refund Sanctioned

31/X/18 FINAL/2018-19, fund of unutilized Rs. 14,839/-

dated 17-7-2018 ITC for the month Refund rejected

of March, 2018 Rs. 2,70,380/-

Rs. 2,85,219/-

2 CGST/JP/ 46/GST/REFUND/ Application for re- Refund Sanctioned

30/X/18 FINAL/2018-19, fund of unutilized Rs. 14,82,799/-

dated 13-9-2018 ITC for the month Refund rejected

of April, 2018 Rs. 9,75,732/-

Rs. 24,58,531/-

2. Brief facts of the case :

2.1 The appellant having GSTIN No. 08AMXPS0057Q1ZZ have filed

applications for refund of unutilized ITC for CESS for the month of March, 2018

and April, 2018. On examination, it was found that the refund claims were liable

GST LAW TIMES 28th May 2020 84