Page 86 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 86

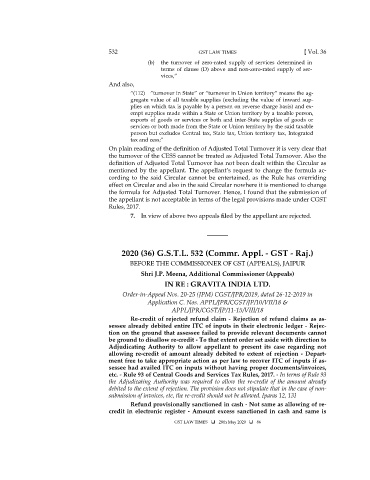

532 GST LAW TIMES [ Vol. 36

(b) the turnover of zero-rated supply of services determined in

terms of clause (D) above and non-zero-rated supply of ser-

vices,”

And also,

“(112) ”turnover in State” or “turnover in Union territory” means the ag-

gregate value of all taxable supplies (excluding the value of inward sup-

plies on which tax is payable by a person on reverse charge basis) and ex-

empt supplies made within a State or Union territory by a taxable person,

exports of goods or services or both and inter-State supplies of goods or

services or both made from the State or Union territory by the said taxable

person but excludes Central tax, State tax, Union territory tax, Integrated

tax and cess;”

On plain reading of the definition of Adjusted Total Turnover it is very clear that

the turnover of the CESS cannot be treated as Adjusted Total Turnover. Also the

definition of Adjusted Total Turnover has not been dealt within the Circular as

mentioned by the appellant. The appellant’s request to change the formula ac-

cording to the said Circular cannot be entertained, as the Rule has overriding

effect on Circular and also in the said Circular nowhere it is mentioned to change

the formula for Adjusted Total Turnover. Hence, I found that the submission of

the appellant is not acceptable in terms of the legal provisions made under CGST

Rules, 2017.

7. In view of above two appeals filed by the appellant are rejected.

_______

2020 (36) G.S.T.L. 532 (Commr. Appl. - GST - Raj.)

BEFORE THE COMMISSIONER OF GST (APPEALS), JAIPUR

Shri J.P. Meena, Additional Commissioner (Appeals)

IN RE : GRAVITA INDIA LTD.

Order-in-Appeal Nos. 20-25 (JPM) CGST/JPR/2019, dated 26-12-2019 in

Application C. Nos. APPL/JPR/CGST/JP/10/VII/18 &

APPL/JPR/CGST/JP/11-15/VIII/18

Re-credit of rejected refund claim - Rejection of refund claims as as-

sessee already debited entire ITC of inputs in their electronic ledger - Rejec-

tion on the ground that assessee failed to provide relevant documents cannot

be ground to disallow re-credit - To that extent order set aside with direction to

Adjudicating Authority to allow appellant to present its case regarding not

allowing re-credit of amount already debited to extent of rejection - Depart-

ment free to take appropriate action as per law to recover ITC of inputs if as-

sessee had availed ITC on inputs without having proper documents/invoices,

etc. - Rule 93 of Central Goods and Services Tax Rules, 2017. - In terms of Rule 93

the Adjudicating Authority was required to allow the re-credit of the amount already

debited to the extent of rejection. The provision does not stipulate that in the case of non-

submission of invoices, etc, the re-credit should not be allowed. [paras 12, 13]

Refund provisionally sanctioned in cash - Not same as allowing of re-

credit in electronic register - Amount excess sanctioned in cash and same is

GST LAW TIMES 28th May 2020 86