Page 157 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 157

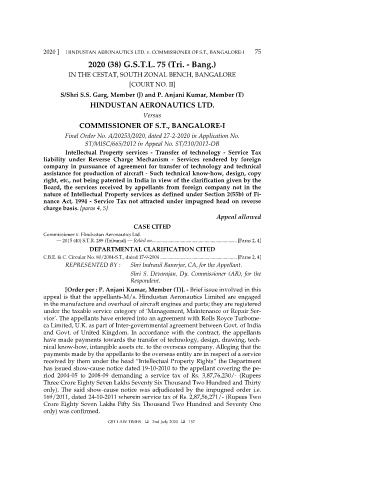

2020 ] HINDUSTAN AERONAUTICS LTD. v. COMMISSIONER OF S.T., BANGALORE-I 75

2020 (38) G.S.T.L. 75 (Tri. - Bang.)

IN THE CESTAT, SOUTH ZONAL BENCH, BANGALORE

[COURT NO. II]

S/Shri S.S. Garg, Member (J) and P. Anjani Kumar, Member (T)

HINDUSTAN AERONAUTICS LTD.

Versus

COMMISSIONER OF S.T., BANGALORE-I

Final Order No. A/20253/2020, dated 27-2-2020 in Application No.

ST/MISC/665/2012 in Appeal No. ST/210/2012-DB

Intellectual Property services - Transfer of technology - Service Tax

liability under Reverse Charge Mechanism - Services rendered by foreign

company in pursuance of agreement for transfer of technology and technical

assistance for production of aircraft - Such technical know-how, design, copy

right, etc., not being patented in India in view of the clarification given by the

Board, the services received by appellants from foreign company not in the

nature of Intellectual Property services as defined under Section 2(55b) of Fi-

nance Act, 1994 - Service Tax not attracted under impugned head on reverse

charge basis. [paras 4, 5]

Appeal allowed

CASE CITED

Commissioner v. Hindustan Aeronautics Ltd.

— 2015 (40) S.T.R. 289 (Tribunal) — Relied on ....................................................................... [Paras 2, 4]

DEPARTMENTAL CLARIFICATION CITED

C.B.E. & C. Circular No. 80/2004-S.T., dated 17-9-2004 ................................................................ [Paras 2, 4]

REPRESENTED BY : Shri Indranil Banerjee, CA, for the Appellant.

Shri S. Devarajan, Dy. Commissioner (AR), for the

Respondent.

[Order per : P. Anjani Kumar, Member (T)]. - Brief issue involved in this

appeal is that the appellants-M/s. Hindustan Aeronautics Limited are engaged

in the manufacture and overhaul of aircraft engines and parts; they are registered

under the taxable service category of ‘Management, Maintenance or Repair Ser-

vice’. The appellants have entered into an agreement with Rolls Royce Turbome-

ca Limited, U.K. as part of Inter-governmental agreement between Govt. of India

and Govt. of United Kingdom. In accordance with the contract, the appellants

have made payments towards the transfer of technology, design, drawing, tech-

nical know-how, intangible assets etc. to the overseas company. Alleging that the

payments made by the appellants to the overseas entity are in respect of a service

received by them under the head “Intellectual Property Rights” the Department

has issued show-cause notice dated 19-10-2010 to the appellant covering the pe-

riod 2004-05 to 2008-09 demanding a service tax of Rs. 3,87,76,230/- (Rupees

Three Crore Eighty Seven Lakhs Seventy Six Thousand Two Hundred and Thirty

only). The said show-cause notice was adjudicated by the impugned order i.e.

169/2011, dated 24-10-2011 wherein service tax of Rs. 2,87,56,271/- (Rupees Two

Crore Eighty Seven Lakhs Fifty Six Thousand Two Hundred and Seventy One

only) was confirmed.

GST LAW TIMES 2nd July 2020 157