Page 203 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 203

2020 ] IN RE : OMSAI PROFESSIONAL DETECTIVE AND SECURITY SERVICES PVT. LTD. 121

Interest - Tax not paid - In view of clear statutory provision that when-

ever any dealer failed to discharge applicable tax in time, is liable to pay inter-

est @ 18% for delayed period - Interest leviable - Section 50 of Central Goods

and Services Tax Act, 2017. [para 25]

Appeal partly allowed

CASE CITED

AAP and Co. v. Union of India — 2019 (26) G.S.T.L. 481 (Guj.) — Relied on ................................ [Para 25]

Commissioner of Income Tax v. Laxminarain Badridas — (1937) 5 ITR 170, 180 — Relied on .... [Para 25]

Commissioner of Sales Tax v. H.M. Esuf Ali Abdulla — (1973) 32 STC 77 SC — Relied on ......... [Para 25]

D. Rama Kotiah and Co. v. State of Andhra Pradesh — Writ Petition No. 33777 of 2018,

decided on 26-9-2018 — Relied on ............................................................................................... [Para 25]

Deepak Industries v. STO — (1998) DLT 718 — Relied on ................................................................. [Para 25]

Sri Krishna Timber Depot v. State of A.P. — (14 APSTJ 238) — Relied on ...................................... [Para 25]

State of A.P. v. Ravuri Narasimhulu — (1965) 16 STC 54 (APHC) — Relied on ............................. [Para 25]

State of Orissa v. B.P. Singh Deo — AIR 1970 SC 670 — Relied on ................................................... [Para 25]

[Order]. - This appeal is filed by M/s. Omsai Professional Detective and

Security Services Private Limited, D. No. 57-3-4, Sri Rama Nilayam, Yadavula

Bazar, Patamata, Vijayawada (hereinafter referred to as ‘Appellant’) against the

tax assessment orders passed by the Assistant Commissioner of State Tax, Pata-

mata Circle, No.-II Division, Vijayawada, (hereinafter referred to as ‘Assessing

Authority’/for short ‘A.A.’) for the tax periods from December, 2017 to August,

2018 under CGST/APGST Act, 2017 in GSTIN : 37AAACO2542G1ZO vide his

orders dated 1-11-2018, disputing the levy of tax of Rs. 75,22,00,588/-.

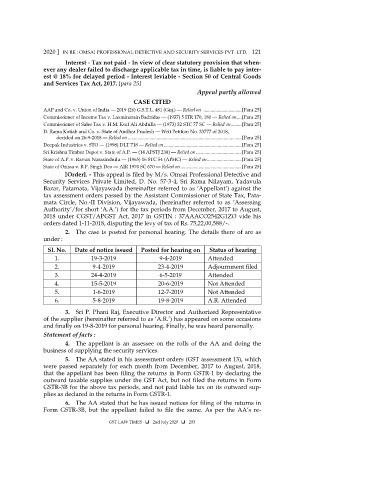

2. The case is posted for personal hearing. The details there of are as

under :

Sl. No. Date of notice issued Posted for hearing on Status of hearing

1. 19-3-2019 9-4-2019 Attended

2. 9-4-2019 23-4-2019 Adjournment filed

3. 24-4-2019 6-5-2019 Attended

4. 15-5-2019 20-6-2019 Not Attended

5. 1-6-2019 12-7-2019 Not Attended

6. 5-8-2019 19-8-2019 A.R. Attended

3. Sri P. Phani Raj, Executive Director and Authorized Representative

of the supplier (hereinafter referred to as ‘A.R.’) has appeared on some occasions

and finally on 19-8-2019 for personal hearing. Finally, he was heard personally.

Statement of facts :

4. The appellant is an assessee on the rolls of the AA and doing the

business of supplying the security services.

5. The AA stated in his assessment orders (GST assessment 13), which

were passed separately for each month from December, 2017 to August, 2018,

that the appellant has been filing the returns in Form GSTR-1 by declaring the

outward taxable supplies under the GST Act, but not filed the returns in Form

GSTR-3B for the above tax periods, and not paid liable tax on its outward sup-

plies as declared in the returns in Form GSTR-1.

6. The AA stated that he has issued notices for filing of the returns in

Form GSTR-3B, but the appellant failed to file the same. As per the AA’s re-

GST LAW TIMES 2nd July 2020 203