Page 199 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 199

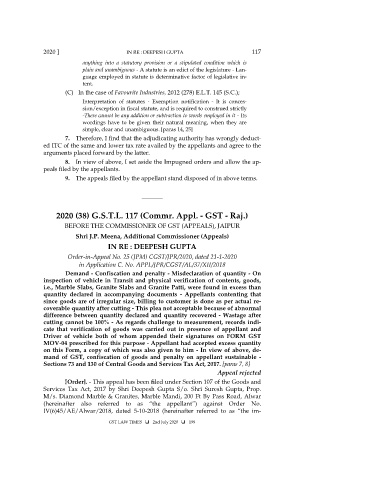

2020 ] IN RE : DEEPESH GUPTA 117

anything into a statutory provision or a stipulated condition which is

plain and unambiguous - A statute is an edict of the legislature - Lan-

guage employed in statute is determinative factor of legislative in-

tent.

(C) In the case of Favourite Industries, 2012 (278) E.L.T. 145 (S.C.);

Interpretation of statutes - Exemption notification - It is conces-

sion/exception in fiscal statute, and is required to construed strictly

-There cannot be any addition or subtraction to words employed in it - Its

wordings have to be given their natural meaning, when they are

simple, clear and unambiguous. [paras 14, 25]

7. Therefore, I find that the adjudicating authority has wrongly deduct-

ed ITC of the same and lower tax rate availed by the appellants and agree to the

arguments placed forward by the latter.

8. In view of above, I set aside the Impugned orders and allow the ap-

peals filed by the appellants.

9. The appeals filed by the appellant stand disposed of in above terms.

_______

2020 (38) G.S.T.L. 117 (Commr. Appl. - GST - Raj.)

BEFORE THE COMMISSIONER OF GST (APPEALS), JAIPUR

Shri J.P. Meena, Additional Commissioner (Appeals)

IN RE : DEEPESH GUPTA

Order-in-Appeal No. 25 (JPM) CGST/JPR/2020, dated 21-1-2020

in Application C. No. APPL/JPR/CGST/AL/37/XII/2018

Demand - Confiscation and penalty - Misdeclaration of quantity - On

inspection of vehicle in Transit and physical verification of contents, goods,

i.e., Marble Slabs, Granite Slabs and Granite Patti, were found in excess than

quantity declared in accompanying documents - Appellants contenting that

since goods are of irregular size, billing to customer is done as per actual re-

coverable quantity after cutting - This plea not acceptable because of abnormal

difference between quantity declared and quantity recovered - Wastage after

cutting cannot be 100% - As regards challenge to measurement, records indi-

cate that verification of goods was carried out in presence of appellant and

Driver of vehicle both of whom appended their signatures on FORM GST

MOV-04 prescribed for this purpose - Appellant had accepted excess quantity

on this Form, a copy of which was also given to him - In view of above, de-

mand of GST, confiscation of goods and penalty on appellant sustainable -

Sections 73 and 130 of Central Goods and Services Tax Act, 2017. [paras 7, 8]

Appeal rejected

[Order]. - This appeal has been filed under Section 107 of the Goods and

Services Tax Act, 2017 by Shri Deepesh Gupta S/o. Shri Suresh Gupta, Prop.

M/s. Diamond Marble & Granites, Marble Mandi, 200 Ft By Pass Road, Alwar

(hereinafter also referred to as “the appellant”) against Order No.

IV(6)45/AE/Alwar/2018, dated 5-10-2018 (hereinafter referred to as “the im-

GST LAW TIMES 2nd July 2020 199