Page 93 - ELT_1st June 2020_VOL 372_Part 5th

P. 93

2020 ] UNION OF INDIA v. E.I. DUPOINT INDIA 627

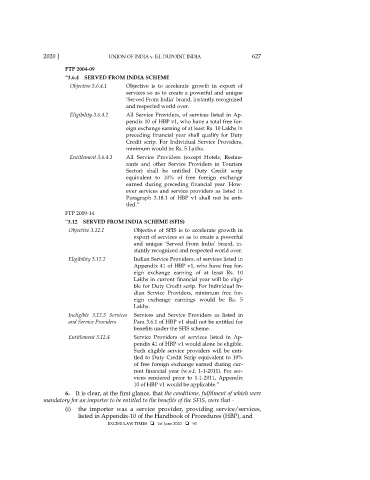

FTP 2004-09

“3.6.4 SERVED FROM INDIA SCHEME

Objective 3.6.4.1 Objective is to accelerate growth in export of

services so as to create a powerful and unique

‘Served From India’ brand, instantly recognized

and respected world over.

Eligibility 3.6.4.2 All Service Providers, of services listed in Ap-

pendix 10 of HBP v1, who have a total free for-

eign exchange earning of at least Rs. 10 Lakhs in

preceding financial year shall qualify for Duty

Credit scrip. For Individual Service Providers,

minimum would be Rs. 5 Lakhs.

Entitlement 3.6.4.3 All Service Providers (except Hotels, Restau-

rants and other Service Providers in Tourism

Sector) shall be entitled Duty Credit scrip

equivalent to 10% of free foreign exchange

earned during preceding financial year. How-

ever services and service providers as listed in

Paragraph 3.18.1 of HBP v1 shall not be enti-

tled.”

FTP 2009-14

“3.12 SERVED FROM INDIA SCHEME (SFIS)

Objective 3.12.1 Objective of SFIS is to accelerate growth in

export of services so as to create a powerful

and unique ‘Served From India’ brand, in-

stantly recognized and respected world over.

Eligibility 3.12.2 Indian Service Providers, of services listed in

Appendix 41 of HBP v1, who have free for-

eign exchange earning of at least Rs. 10

Lakhs in current financial year will be eligi-

ble for Duty Credit scrip. For Individual In-

dian Service Providers, minimum free for-

eign exchange earnings would be Rs. 5

Lakhs.

Ineligible 3.12.3 Services Services and Service Providers as listed in

and Service Providers Para 3.6.1 of HBP v1 shall not be entitled for

benefits under the SFIS scheme.

Entitlement 3.12.4 Service Providers of services listed in Ap-

pendix 41 of HBP v1 would alone be eligible.

Such eligible service providers will be enti-

tled to Duty Credit Scrip equivalent to 10%

of free foreign exchange earned during cur-

rent financial year (w.e.f. 1-1-2011). For ser-

vices rendered prior to 1-1-2011, Appendix

10 of HBP v1 would be applicable.”

6. It is clear, at the first glance, that the conditions, fulfilment of which were

mandatory for an importer to be entitled to the benefits of the SFIS, were that -

(i) the importer was a service provider, providing service/services,

listed in Appendix-10 of the Handbook of Procedures (HBP), and

EXCISE LAW TIMES 1st June 2020 93