Page 129 - GSTL_14th May 2020_Vol 36_Part 2

P. 129

2020 ] IN RE : PRAYAGRAJ DYEING & PRINTING MILLS PVT. LTD. 231

[Order]. - Advance Ruling No. GUJ/GAAR/R/2019/23 (in Application

No. Advance Ruling/SGST & CGST/2018/AR/21).

2. The Applicant, vide Annexure ‘A’ attached with Form GST ARA-01,

dated 19-4-2018, mentioned their queries as under :

Query

Whether Bagasse based Particle Board manufactured with a composition

of 75% of bagasse, 25% of wood particles and 5 kgs. of resins falls under Serial

No. 92 of Schedule II (GST rate 12%) or under Sr. No. 137A of Schedule III (GST

rate 18%) of the Notification No. 1/2017-Integrated Tax (Rate), dated 28-6-2017?

2.1 The Applicant, vide attached sheet “Annexure B” to their applica-

tion dated 6-4-2018, has submitted the Statement of relevant facts having a bear-

ing on the question raised is as follows :

(i) M/s. Prayagraj Dyeing & Printing Mills Pvt. Ltd. is registered under

Goods and Services Tax Act, 2017 vide GSTIN 24AABCP4044R1Z5

(hereinafter referred as “the applicant”) and is planning to manufac-

ture bagasse-based particleboard. The basic raw materials used for

manufacturing of bagasse-based particleboard are “Bagasse” &

“Rasins”. Due to shortage of basic raw material “Bagasse” in the

market, the applicant sometime mixes some amount of wood parti-

cles, which may extent to maximum 25% of the total particle board

composition.

(ii) The rate of GST to be levied under Goods and Services Tax Act,

2017 is provided in Notification No. 1/2017-IGST (Rate), dated 28-6-

2017. Sr. No. 92 of Schedule-II of Notification No. 1/2017-IGST

(Rate), dated 28-6-2017 provides for 12% GST rate for “Bagasse

Board” falling under Chapter 44 or any chapter of the Customs Tar-

iff Act. The relevant Sr. No. 92 Schedule-II of Notification No.

1/2017-IGST (Rate), dated 28-6-2017 is reproduced hereunder :

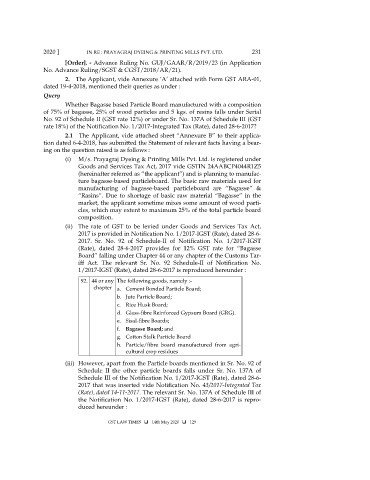

92. 44 or any The following goods, namely :-

chapter a. Cement Bonded Particle Board;

b. Jute Particle Board;

c. Rice Husk Board;

d. Glass-fibre Reinforced Gypsum Board (GRG).

e. Sisal-fibre Boards;

f. Bagasse Board; and

g. Cotton Stalk Particle Board

h. Particle/fibre board manufactured from agri-

cultural crop residues

(iii) However, apart from the Particle boards mentioned in Sr. No. 92 of

Schedule II the other particle boards falls under Sr. No. 137A of

Schedule III of the Notification No. 1/2017-IGST (Rate), dated 28-6-

2017 that was inserted vide Notification No. 43/2017-Integrated Tax

(Rate), dated 14-11-2017. The relevant Sr. No. 137A of Schedule III of

the Notification No. 1/2017-IGST (Rate), dated 28-6-2017 is repro-

duced hereunder :

GST LAW TIMES 14th May 2020 129