Page 126 - GSTL_14th May 2020_Vol 36_Part 2

P. 126

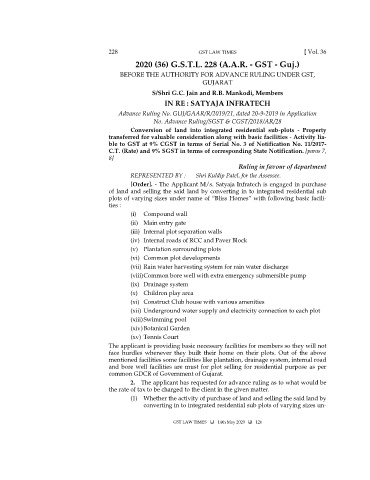

228 GST LAW TIMES [ Vol. 36

2020 (36) G.S.T.L. 228 (A.A.R. - GST - Guj.)

BEFORE THE AUTHORITY FOR ADVANCE RULING UNDER GST,

GUJARAT

S/Shri G.C. Jain and R.B. Mankodi, Members

IN RE : SATYAJA INFRATECH

Advance Ruling No. GUJ/GAAR/R/2019/21, dated 20-9-2019 in Application

No. Advance Ruling/SGST & CGST/2018/AR/28

Conversion of land into integrated residential sub-plots - Property

transferred for valuable consideration along with basic facilities - Activity lia-

ble to GST at 9% CGST in terms of Serial No. 3 of Notification No. 11/2017-

C.T. (Rate) and 9% SGST in terms of corresponding State Notification. [paras 7,

8]

Ruling in favour of department

REPRESENTED BY : Shri Kuldip Patel, for the Assessee.

[Order]. - The Applicant M/s. Satyaja Infratech is engaged in purchase

of land and selling the said land by converting in to integrated residential sub

plots of varying sizes under name of “Bliss Homes” with following basic facili-

ties :

(i) Compound wall

(ii) Main entry gate

(iii) Internal plot separation walls

(iv) Internal roads of RCC and Paver Block

(v) Plantation surrounding plots

(vi) Common plot developments

(vii) Rain water harvesting system for rain water discharge

(viii) Common bore well with extra emergency submersible pump

(ix) Drainage system

(x) Children play area

(xi) Construct Club house with various amenities

(xii) Underground water supply and electricity connection to each plot

(xiii) Swimming pool

(xiv) Botanical Garden

(xv) Tennis Court

The applicant is providing basic necessary facilities for members so they will not

face hurdles whenever they built their home on their plots. Out of the above

mentioned facilities some facilities like plantation, drainage system, internal road

and bore well facilities are must for plot selling for residential purpose as per

common GDCR of Government of Gujarat.

2. The applicant has requested for advance ruling as to what would be

the rate of tax to be charged to the client in the given matter.

(1) Whether the activity of purchase of land and selling the said land by

converting in to integrated residential sub plots of varying sizes un-

GST LAW TIMES 14th May 2020 126