Page 148 - GSTL_14th May 2020_Vol 36_Part 2

P. 148

250 GST LAW TIMES [ Vol. 36

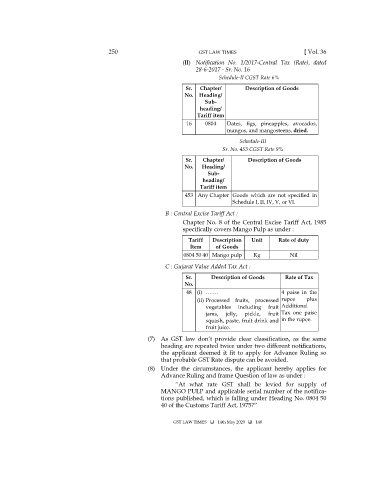

(II) Notification No. 1/2017-Central Tax (Rate), dated

28-6-2017 - Sr. No. 16

Schedule-II CGST Rate 6%

Sr. Chapter/ Description of Goods

No. Heading/

Sub-

heading/

Tariff item

16 0804 Dates, figs, pineapples, avocados,

mangos, and mangosteens, dried.

Schedule-III

Sr. No. 453 CGST Rate 9%

Sr. Chapter/ Description of Goods

No. Heading/

Sub-

heading/

Tariff item

453 Any Chapter Goods which are not specified in

Schedule I, II, IV, V, or VI.

B : Central Excise Tariff Act :

Chapter No. 8 of the Central Excise Tariff Act, 1985

specifically covers Mango Pulp as under :

Tariff Description Unit Rate of duty

Item of Goods

0804 50 40 Mango pulp Kg Nil

C : Gujarat Value Added Tax Act :

Sr. Description of Goods Rate of Tax

No.

48 (i) ……. 4 paise in the

(ii) Processed fruits, processed rupee plus

vegetables including fruit Additional

jams, jelly, pickle, fruit Tax one paise

squash, paste, fruit drink and in the rupee.

fruit juice.

(7) As GST law don’t provide clear classification, as the same

heading are repeated twice under two different notifications,

the applicant deemed it fit to apply for Advance Ruling so

that probable GST Rate dispute can be avoided.

(8) Under the circumstances, the applicant hereby applies for

Advance Ruling and frame Question of law as under :

“At what rate GST shall be levied for supply of

MANGO PULP and applicable serial number of the notifica-

tions published, which is falling under Heading No. 0804 50

40 of the Customs Tariff Act, 1975?”

GST LAW TIMES 14th May 2020 148