Page 149 - GSTL_14th May 2020_Vol 36_Part 2

P. 149

2020 ] IN RE : UNIVERSAL IMPORT EXPORT 251

2.2 The Applicant, vide attached sheet “Annexure B” to their applica-

tion dated 6-4-2018, has submitted the Statement containing the applicants inter-

pretation of law and/or facts which is as follows :

(1) Notification No. 1/2017-Central Tax (Rate) and No. 2/2017-Central

Tax (Rate), both dated 28-6-2017, provides that for the purpose of

this notification, “Tariff item”, “sub-heading”, heading and “Chap-

ter” shall mean respectively a tariff item, sub-heading, heading, and

chapter as specified in the First Schedule to the Customs Tariff Act,

1975 (51 of 1975). Therefore, classification of the any goods shall be

in accordance with the classification of the CTA. Annexed hereto

and marked as “ANNEXURE-C” is copy of “Rules for interpretation

of Customs Tariff.

(2) Accordingly, “Rules for interpretation of Customs Tariff” read with

“General Explanatory Notes” appended therewith shall be applied

for determination of classification of any goods. As per CTA, HS

code relating to Mango Pulp is as under :

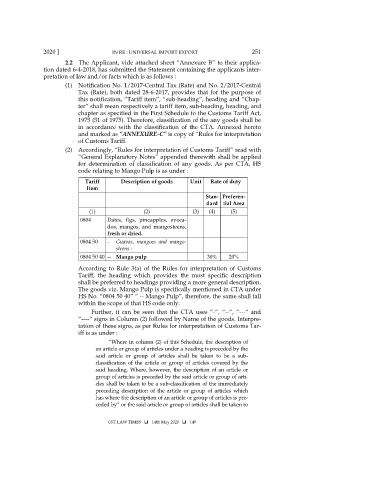

Tariff Description of goods Unit Rate of duty

Item

Stan- Preferen-

dard tial Area

(1) (2) (3) (4) (5)

0804 Dates, figs, pineapples, avoca-

dos, mangos, and mangosteens,

fresh or dried.

0804 50 - Guavas, mangoes and mango-

steens :

0804 50 40 -- Mango pulp 30% 20%

According to Rule 3(a) of the Rules for interpretation of Customs

Tariff, the heading which provides the most specific description

shall be preferred to headings providing a more general description.

The goods viz. Mango Pulp is specifically mentioned in CTA under

HS No. “0804 50 40” “ -- Mango Pulp”, therefore, the same shall fall

within the scope of that HS code only.

Further, it can be seen that the CTA uses “-“, “--“, “---“ and

“----“ signs in Column (2) followed by Name of the goods. Interpre-

tation of these signs, as per Rules for interpretation of Customs Tar-

iff is as under :

“Where in column (2) of this Schedule, the description of

an article or group of articles under a heading is preceded by the

said article or group of articles shall be taken to be a sub-

classification of the article or group of articles covered by the

said heading. Where, however, the description of an article or

group of articles is preceded by the said article or group of arti-

cles shall be taken to be a sub-classification of the immediately

preceding description of the article or group of articles which

has where the description of an article or group of articles is pre-

ceded by” or the said article or group of articles shall be taken to

GST LAW TIMES 14th May 2020 149