Page 152 - GSTL_14th May 2020_Vol 36_Part 2

P. 152

254 GST LAW TIMES [ Vol. 36

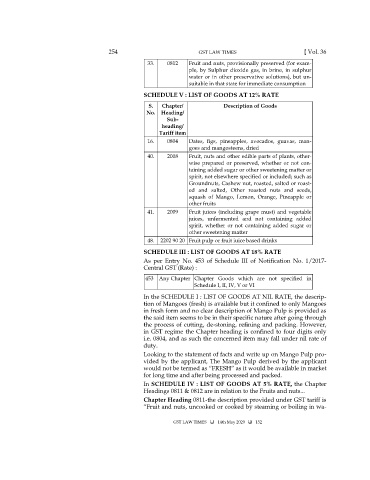

33. 0812 Fruit and nuts, provisionally preserved (for exam-

ple, by Sulphur dioxide gas, in brine, in sulphur

water or in other preservative solutions), but un-

suitable in that state for immediate consumption

SCHEDULE V : LIST OF GOODS AT 12% RATE

S. Chapter/ Description of Goods

No. Heading/

Sub-

heading/

Tariff item

16. 0804 Dates, figs, pineapples, avocados, guavas, man-

goes and mangosteens, dried

40. 2008 Fruit, nuts and other edible parts of plants, other-

wise prepared or preserved, whether or not con-

taining added sugar or other sweetening matter or

spirit, not elsewhere specified or included; such as

Groundnuts, Cashew nut, roasted, salted or roast-

ed and salted, Other roasted nuts and seeds,

squash of Mango, Lemon, Orange, Pineapple or

other fruits

41. 2009 Fruit juices (including grape must) and vegetable

juices, unfermented and not containing added

spirit, whether or not containing added sugar or

other sweetening matter

48. 2202 90 20 Fruit pulp or fruit iuice based drinks

SCHEDULE III : LIST OF GOODS AT 18% RATE

As per Entry No. 453 of Schedule III of Notification No. 1/2017-

Central GST (Rate) :

453 Any Chapter Chapter Goods which are not specified in

Schedule I, II, IV, V or VI

In the SCHEDULE I : LIST OF GOODS AT NIL RATE, the descrip-

tion of Mangoes (fresh) is available but it confined to only Mangoes

in fresh form and no clear description of Mango Pulp is provided as

the said item seems to be in their specific nature after going through

the process of cutting, de-stoning, refining and packing. However,

in GST regime the Chapter heading is confined to four digits only

i.e. 0804, and as such the concerned item may fall under nil rate of

duty.

Looking to the statement of facts and write up on Mango Pulp pro-

vided by the applicant, The Mango Pulp derived by the applicant

would not be termed as “FRESH” as it would be available in market

for long time and after being processed and packed.

In SCHEDULE IV : LIST OF GOODS AT 5% RATE, the Chapter

Headings 0811 & 0812 are in relation to the Fruits and nuts...

Chapter Heading 0811-the description provided under GST tariff is

“Fruit and nuts, uncooked or cooked by steaming or boiling in wa-

GST LAW TIMES 14th May 2020 152