Page 151 - GSTL_14th May 2020_Vol 36_Part 2

P. 151

2020 ] IN RE : UNIVERSAL IMPORT EXPORT 253

M/s. Universal Import Export, 15, Tirupati Complex, Gundran

Road, Talala is registered under GST having GSTIN-

24AAEFU7782R1Z8, and is under the jurisdiction of Veraval, State

GST Authority. Further, the said unit was also not registered with

Central Excise, resulting into non-availability of records. Hence, it is

inferred that the activity/service is ‘proposed’ one.

(2) No such questions/issues raised in the Application are pending or

decided, in view of the (1) above.

(3) The applicant is seeking “At what rate GST payable on supply of

Mango Pulp falling under the Heading No. 0804 50 40 of Customs

Tariff Act, 1975 and rate of GST? Equivalent Heading under GST

law is 0804 and as such they have sought for classification of goods

and applicability of Notification in connection with the rate of GST

chargeable on supply of their goods viz. Mango Pulp. In GST re-

gime, no separate Tariff Schedule has been enacted and Customs

Tariff Act, 1975 has been adopted for the purpose of classification of

goods under GST. Whereas the rates of GST are charged on the ba-

sis Notification issued by the Government as per recommendations

of GST Council.

(4) Therefore, while observing the scope of applicability of rate in GST

regime, it is required to examine the category of Fruit or of Fruit

Pulp also, in absence of clear cut description of Mango Pulp. The

classification may fall under either of following Chapter Heads :

(1) Chapter 8 : Edible fruit and nuts; peel of citrus fruit or melons

(2) Chapter 20 : Preparations of Vegetables, fruit, nuts or other

parts of plant.

(3) Chapter 22 : Beverages, spirits and vinegar

(5) Anyone of the following may be applicable for the sake of classifica-

tion of Mango Pulp as there is no clear/specific description of Man-

go Pulp available in the GST Tariff :

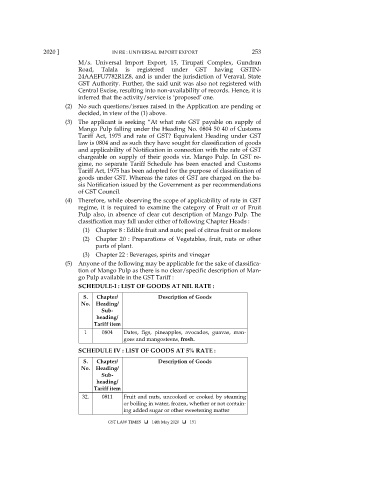

SCHEDULE-I : LIST OF GOODS AT NIL RATE :

S. Chapter/ Description of Goods

No. Heading/

Sub-

heading/

Tariff item

1 0804 Dates, figs, pineapples, avocados, guavas, man-

goes and mangosteens, fresh.

SCHEDULE IV : LIST OF GOODS AT 5% RATE :

S. Chapter/ Description of Goods

No. Heading/

Sub-

heading/

Tariff item

32. 0811 Fruit and nuts, uncooked or cooked by steaming

or boiling in water, frozen, whether or not contain-

ing added sugar or other sweetening matter

GST LAW TIMES 14th May 2020 151