Page 155 - GSTL_14th May 2020_Vol 36_Part 2

P. 155

2020 ] IN RE : NATIONAL DAIRY DEVELOPMENT BOARD 257

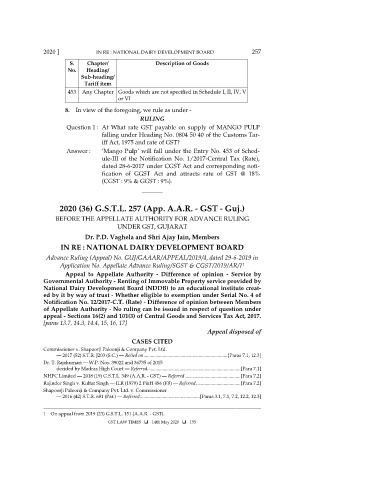

S. Chapter/ Description of Goods

No. Heading/

Sub-heading/

Tariff item

453 Any Chapter Goods which are not specified in Schedule I, II, IV, V

or VI

8. In view of the foregoing, we rule as under -

RULING

Question 1 : At What rate GST payable on supply of MANGO PULP

falling under Heading No. 0804 50 40 of the Customs Tar-

iff Act, 1975 and rate of GST?

Answer : ‘Mango Pulp’ will fall under the Entry No. 453 of Sched-

ule-III of the Notification No. 1/2017-Central Tax (Rate),

dated 28-6-2017 under CGST Act and corresponding noti-

fication of GGST Act and attracts rate of GST @ 18%

(CGST : 9% & GGST : 9%).

_______

2020 (36) G.S.T.L. 257 (App. A.A.R. - GST - Guj.)

BEFORE THE APPELLATE AUTHORITY FOR ADVANCE RULING

UNDER GST, GUJARAT

Dr. P.D. Vaghela and Shri Ajay Jain, Members

IN RE : NATIONAL DAIRY DEVELOPMENT BOARD

Advance Ruling (Appeal) No. GUJ/GAAAR/APPEAL/2019/4, dated 29-6-2019 in

1

Application No. Appellate Advance Ruling/SGST & CGST/2019/AR/1

Appeal to Appellate Authority - Difference of opinion - Service by

Governmental Authority - Renting of Immovable Property service provided by

National Dairy Development Board (NDDB) to an educational institute creat-

ed by it by way of trust - Whether eligible to exemption under Serial No. 4 of

Notification No. 12/2017-C.T. (Rate) - Difference of opinion between Members

of Appellate Authority - No ruling can be issued in respect of question under

appeal - Sections 16(2) and 101(3) of Central Goods and Services Tax Act, 2017.

[paras 13.7, 14.3, 14.4, 15, 16, 17]

Appeal disposed of

CASES CITED

Commissioner v. Shapoorji Paloonji & Company Pvt. Ltd.

— 2017 (52) S.T.R. J203 (S.C.) — Relied on ...................................................................... [Paras 7.1, 12.3]

Dr. T. Rajakumari — W.P. Nos. 39022 and 36735 of 2015

decided by Madras High Court — Referred.............................................................................. [Para 7.1]

NHPC Limited — 2018 (19) G.S.T.L. 349 (A.A.R. - GST) — Referred .............................................. [Para 7.2]

Rajinder Singh v. Kultar Singh — ILR (1979) 2 P&H 486 (FB) — Referred ..................................... [Para 7.2]

Shapoorji Paloonji & Company Pvt. Ltd. v. Commissioner

— 2016 (42) S.T.R. 681 (Pat.) — Referred .................................................. [Paras 3.1, 7.1, 7.2, 12.2, 12.3]

________________________________________________________________________

1 On appeal from 2019 (23) G.S.T.L. 151 (A.A.R. - GST).

GST LAW TIMES 14th May 2020 155