Page 124 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 124

570 GST LAW TIMES [ Vol. 36

carbonated beverages with fruit flavours manufactured prior

to 27th November, 2017.

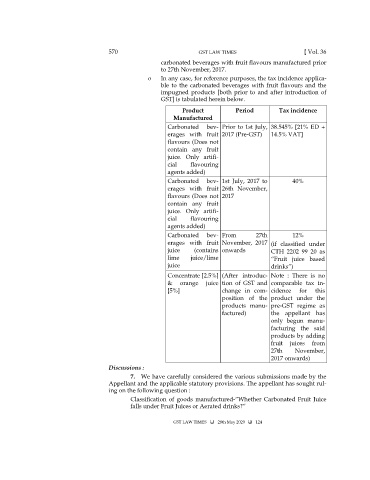

o In any case, for reference purposes, the tax incidence applica-

ble to the carbonated beverages with fruit flavours and the

impugned products [both prior to and after introduction of

GST] is tabulated herein below.

Product Period Tax incidence

Manufactured

Carbonated bev- Prior to 1st July, 38.545% [21% ED +

erages with fruit 2017 (Pre-GST) 14.5% VAT]

flavours (Does not

contain any fruit

juice. Only artifi-

cial flavouring

agents added)

Carbonated bev- 1st July, 2017 to 40%

erages with fruit 26th November,

flavours (Does not 2017

contain any fruit

juice. Only artifi-

cial flavouring

agents added)

Carbonated bev- From 27th 12%

erages with fruit November, 2017 (if classified under

juice (contains onwards CTH 2202 99 20 as

lime juice/lime “Fruit juice based

juice drinks”)

Concentrate [2.5%] (After introduc- Note : There is no

& orange juice tion of GST and comparable tax in-

[5%] change in com- cidence for this

position of the product under the

products manu- pre-GST regime as

factured) the appellant has

only begun manu-

facturing the said

products by adding

fruit juices from

27th November,

2017 onwards)

Discussions :

7. We have carefully considered the various submissions made by the

Appellant and the applicable statutory provisions. The appellant has sought rul-

ing on the following question :

Classification of goods manufactured-”Whether Carbonated Fruit Juice

falls under Fruit Juices or Aerated drinks?”

GST LAW TIMES 28th May 2020 124