Page 127 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 127

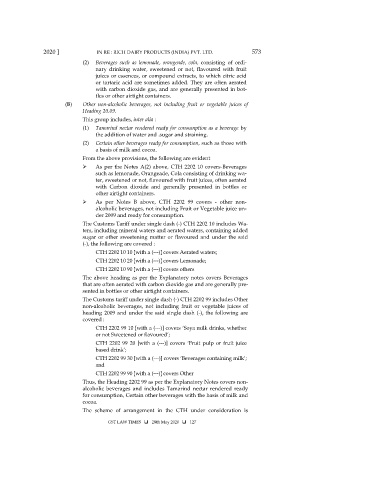

2020 ] IN RE : RICH DAIRY PRODUCTS (INDIA) PVT. LTD. 573

(2) Beverages such as lemonade, orangeade, cola, consisting of ordi-

nary drinking water, sweetened or not, flavoured with fruit

juices or essences, or compound extracts, to which citric acid

or tartaric acid are sometimes added. They are often aerated

with carbon dioxide gas, and are generally presented in bot-

tles or other airtight containers.

(B) Other non-alcoholic beverages, not including fruit or vegetable juices of

Heading 20.09.

This group includes, inter alia :

(1) Tamarind nectar rendered ready for consumption as a beverage by

the addition of water and .sugar and straining.

(2) Certain other beverages ready for consumption, such as those with

a basis of milk and cocoa.

From the above provisions, the following are evident

As per the Notes A(2) above, CTH 2202 10 covers-Beverages

such as lemonade, Orangeade, Cola consisting of drinking wa-

ter, sweetened or not, flavoured with fruit juices, often aerated

with Carbon dioxide and generally presented in bottles or

other airtight containers.

As per Notes B above, CTH 2202 99 covers - other non-

alcoholic beverages, not including Fruit or Vegetable juice un-

der 2009 and ready for consumption.

The Customs Tariff under single dash (-) CTH 2202 10 includes Wa-

ters, including mineral waters and aerated waters, containing added

sugar or other sweetening matter or flavoured and under the said

(-), the following are covered :

CTH 2202 10 10 [with a (---)] covers Aerated waters;

CTH 2202 10 20 [with a (---)] covers Lemonade;

CTH 2202 10 90 [with a (---)] covers others

The above heading as per the Explanatory notes covers Beverages

that are often aerated with carbon dioxide gas and are generally pre-

sented in bottles or other airtight containers.

The Customs tariff under single dash (-) CTH 2202 99 includes Other

non-alcoholic beverages, not including fruit or vegetable juices of

heading 2009 and under the said single dash (-), the following are

covered :

CTH 2202 99 10 [with a (---)] covers ‘Soya milk drinks, whether

or not Sweetened or flavoured’;

CTH 2202 99 20 [with a (---)] covers ‘Fruit pulp or fruit juice

based drink’;

CTH 2202 99 30 [with a (---)] covers ‘Beverages containing milk’;

and

CTH 2202 99 90 [with a (---)] covers Other

Thus, the Heading 2202 99 as per the Explanatory Notes covers non-

alcoholic beverages and includes Tamarind nectar rendered ready

for consumption, Certain other beverages with the basis of milk and

cocoa.

The scheme of arrangement in the CTH under consideration is

GST LAW TIMES 28th May 2020 127