Page 133 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 133

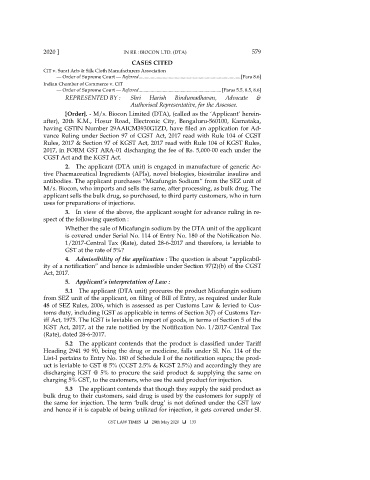

2020 ] IN RE : BIOCON LTD. (DTA) 579

CASES CITED

CIT v. Surat Arts & Silk Cloth Manufacturers Association

— Order of Supreme Court — Referred ..................................................................................... [Para 8.6]

Indian Chamber of Commerce v. CIT

— Order of Supreme Court — Referred ..................................................................... [Paras 5.5, 8.5, 8.6]

REPRESENTED BY : Shri Harish Bindumadhavan, Advocate &

Authorised Representative, for the Assessee.

[Order]. - M/s. Biocon Limited (DTA), (called as the ‘Applicant’ herein-

after), 20th K.M., Hosur Road, Electronic City, Bengaluru-560100, Karnataka,

having GSTIN Number 29AAICM3930G1ZD, have filed an application for Ad-

vance Ruling under Section 97 of CGST Act, 2017 read with Rule 104 of CGST

Rules, 2017 & Section 97 of KGST Act, 2017 read with Rule 104 of KGST Rules,

2017, in FORM GST ARA-01 discharging the fee of Rs. 5,000-00 each under the

CGST Act and the KGST Act.

2. The applicant (DTA unit) is engaged in manufacture of generic Ac-

tive Pharmaceutical Ingredients (APIs), novel biologies, biosimilar insulins and

antibodies. The applicant purchases “Micafungin Sodium” from the SEZ unit of

M/s. Biocon, who imports and sells the same, after processing, as bulk drug. The

applicant sells the bulk drug, so purchased, to third party customers, who in turn

uses for preparations of injections.

3. In view of the above, the applicant sought for advance ruling in re-

spect of the following question :

Whether the sale of Micafungin sodium by the DTA unit of the applicant

is covered under Serial No. 114 of Entry No. 180 of the Notification No.

1/2017-Central Tax (Rate), dated 28-6-2017 and therefore, is leviable to

GST at the rate of 5%?

4. Admissibility of the application : The question is about “applicabil-

ity of a notification” and hence is admissible under Section 97(2)(b) of the CGST

Act, 2017.

5. Applicant’s interpretation of Law :

5.1 The applicant (DTA unit) procures the product Micafungin sodium

from SEZ unit of the applicant, on filing of Bill of Entry, as required under Rule

48 of SEZ Rules, 2006, which is assessed as per Customs Law & levied to Cus-

toms duty, including IGST as applicable in terms of Section 3(7) of Customs Tar-

iff Act, 1975. The IGST is leviable on import of goods, in terms of Section 5 of the

IGST Act, 2017, at the rate notified by the Notification No. 1/2017-Central Tax

(Rate), dated 28-6-2017.

5.2 The applicant contends that the product is classified under Tariff

Heading 2941 90 90, being the drug or medicine, falls under Sl. No. 114 of the

List-I pertains to Entry No. 180 of Schedule I of the notification supra; the prod-

uct is leviable to GST @ 5% (CGST 2.5% & KGST 2.5%) and accordingly they are

discharging IGST @ 5% to procure the said product & supplying the same on

charging 5% GST, to the customers, who use the said product for injection.

5.3 The applicant contends that though they supply the said product as

bulk drug to their customers, said drug is used by the customers for supply of

the same for injection. The term ‘bulk drug’ is not defined under the GST law

and hence if it is capable of being utilized for injection, it gets covered under Sl.

GST LAW TIMES 28th May 2020 133