Page 137 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 137

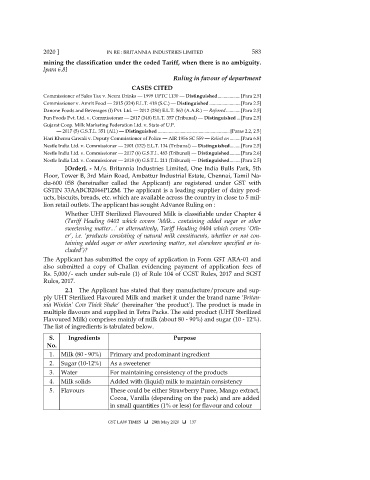

2020 ] IN RE : BRITANNIA INDUSTRIES LIMITED 583

mining the classification under the coded Tariff, when there is no ambiguity.

[para 6.8]

Ruling in favour of department

CASES CITED

Commissioner of Sales Tax v. Neera Drinks — 1999 UPTC 1130 — Distinguished ................... [Para 2.5]

Commissioner v. Amrit Food — 2015 (324) E.L.T. 418 (S.C.) — Distinguished .......................... [Para 2.5]

Danone Foods and Beverages (I) Pvt. Ltd. — 2012 (280) E.L.T. 563 (A.A.R.) — Referred ............ [Para 2.5]

Fun Foods Pvt. Ltd. v. Commissioner — 2017 (348) E.L.T. 357 (Tribunal) — Distinguished ... [Para 2.5]

Gujarat Coop. Milk Marketing Federation Ltd. v. State of U.P.

— 2017 (5) G.S.T.L. 351 (All.) — Distinguished ............................................................ [Paras 2.2, 2.5]

Hari Khemu Gawali v. Deputy Commissioner of Police — AIR 1956 SC 559 — Relied on ......... [Para 6.8]

Nestle India Ltd. v. Commissioner — 2001 (132) E.L.T. 134 (Tribunal) — Distinguished ......... [Para 2.5]

Nestle India Ltd. v. Commissioner — 2017 (6) G.S.T.L. 483 (Tribunal) — Distinguished ......... [Para 2.6]

Nestle India Ltd. v. Commissioner — 2018 (8) G.S.T.L. 211 (Tribunal) — Distinguished ......... [Para 2.5]

[Order]. - M/s. Britannia Industries Limited, One India Bulls Park, 5th

Floor, Tower B, 3rd Main Road, Ambattur Industrial Estate, Chennai, Tamil Na-

du-600 058 (hereinafter called the Applicant) are registered under GST with

GSTIN 33AABCB2066P1ZM. The applicant is a leading supplier of dairy prod-

ucts, biscuits, breads, etc. which are available across the country in close to 5 mil-

lion retail outlets. The applicant has sought Advance Ruling on :

Whether UHT Sterilized Flavoured Milk is classifiable under Chapter 4

(Tariff Heading 0402 which covers ‘Milk... containing added sugar or other

sweetening matter...’ or alternatively, Tariff Heading 0404 which covers ‘Oth-

er’, i.e. ‘products consisting of natural milk constituents, whether or not con-

taining added sugar or other sweetening matter, not elsewhere specified or in-

cluded’)?

The Applicant has submitted the copy of application in Form GST ARA-01 and

also submitted a copy of Challan evidencing payment of application fees of

Rs. 5,000/- each under sub-rule (1) of Rule 104 of CGST Rules, 2017 and SGST

Rules, 2017.

2.1 The Applicant has stated that they manufacture/procure and sup-

ply UHT Sterilized Flavoured Milk and market it under the brand name ‘Britan-

nia Winkin’ Cow Thick Shake’ (hereinafter ‘the product’). The product is made in

multiple flavours and supplied in Tetra Packs. The said product (UHT Sterilized

Flavoured Milk) comprises mainly of milk (about 80 - 90%) and sugar (10 - 12%).

The list of ingredients is tabulated below.

S. Ingredients Purpose

No.

1. Milk (80 - 90%) Primary and predominant ingredient

2. Sugar (10-12%) As a sweetener

3. Water For maintaining consistency of the products

4. Milk solids Added with (liquid) milk to maintain consistency

5. Flavours These could be either Strawberry Puree, Mango extract,

Cocoa, Vanilla (depending on the pack) and are added

in small quantities (1% or less) for flavour and colour

GST LAW TIMES 28th May 2020 137