Page 149 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 149

2020 ] IN RE : BRITANNIA INDUSTRIES LIMITED 595

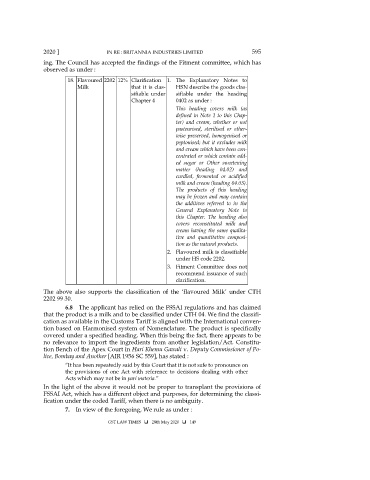

ing. The Council has accepted the findings of the Fitment committee, which has

observed as under :

18. Flavoured 2202 12% Clarification 1. The Explanatory Notes to

Milk that it is clas- HSN describe the goods clas-

sifiable under sifiable under the heading

Chapter 4 0402 as under :

This heading covers milk (as

defined in Note 1 to this Chap-

ter) and cream, whether or not

pasteurised, sterilised or other-

wise preserved, homogenised or

peptonised; but it excludes milk

and cream which have been con-

centrated or which contain add-

ed sugar or Other sweetening

matter (heading 04.02) and

curdled, fermented or acidified

milk and cream (heading 04.03).

The products of this heading

may be frozen and may contain

the additives referred to in the

General Explanatory Note to

this Chapter. The heading also

covers reconstituted milk and

cream having the same qualita-

tive and quantitative composi-

tion as the natural products.

2. Flavoured milk is classifiable

under HS code 2202.

3. Fitment Committee does not

recommend issuance of such

clarification.

The above also supports the classification of the ‘flavoured Milk’ under CTH

2202 99 30.

6.8 The applicant has relied on the FSSAI regulations and has claimed

that the product is a milk and to be classified under CTH 04. We find the classifi-

cation as available in the Customs Tariff is aligned with the International conven-

tion based on Harmonised system of Nomenclature. The product is specifically

covered under a specified heading. When this being the fact, there appears to be

no relevance to import the ingredients from another legislation/Act. Constitu-

tion Bench of the Apex Court in Hari Khemu Gawali v. Deputy Commissioner of Po-

lice, Bombay and Another [AIR 1956 SC 559], has stated :

“It has been repeatedly said by this Court that it is not safe to pronounce on

the provisions of one Act with reference to decisions dealing with other

Acts which may not be in pari materia.”

In the light of the above it would not be proper to transplant the provisions of

FSSAI Act, which has a different object and purposes, for determining the classi-

fication under the coded Tariff, when there is no ambiguity.

7. In view of the foregoing, We rule as under :

GST LAW TIMES 28th May 2020 149