Page 147 - GSTL_ 28th May 2020_Vol 36_Part 4

P. 147

2020 ] IN RE : BRITANNIA INDUSTRIES LIMITED 593

the plausible CTH will be 0404 90 only and there again the Explanatory notes

clearly states that this heading includes products which lack one or more natural

milk constituents, to which natural milk constituents are added, whereas in the

case at hand, the product do not lack any natural milk constituents nor any natu-

ral milk constituents is added to the product. Therefore, we hold that the product

is not classifiable under either CTH 0402 or 0404.

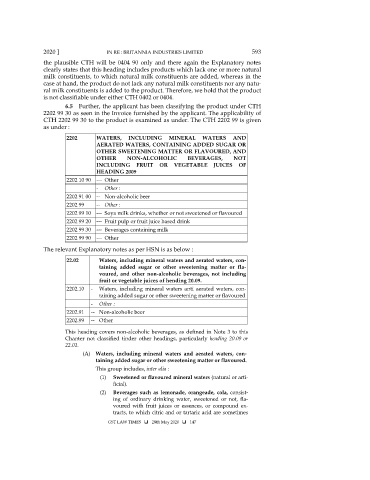

6.5 Further, the applicant has been classifying the product under CTH

2202 99 30 as seen in the Invoice furnished by the applicant. The applicability of

CTH 2202 99 30 to the product is examined as under. The CTH 2202 99 is given

as under :

2202 WATERS, INCLUDING MINERAL WATERS AND

AERATED WATERS, CONTAINING ADDED SUGAR OR

OTHER SWEETENING MATTER OR FLAVOURED, AND

OTHER NON-ALCOHOLIC BEVERAGES, NOT

INCLUDING FRUIT OR VEGETABLE JUICES OF

HEADING 2009

2202 10 90 --- Other

- Other :

2202 91 00 -- Non-alcoholic beer

2202 99 -- Other :

2202 99 10 --- Soya milk drinks, whether or not sweetened or flavoured

2202 99 20 --- Fruit pulp or fruit juice based drink

2202 99 30 --- Beverages containing milk

2202 99 90 --- Other

The relevant Explanatory notes as per HSN is as below :

22.02 Waters, including mineral waters and aerated waters, con-

taining added sugar or other sweetening matter or fla-

voured, and other non-alcoholic beverages, not including

fruit or vegetable juices of hending 20.09.

2202.10 - Waters, including mineral waters anti aerated waters, con-

taining added sugar or other sweetening matter or flavoured

- Other :

2202.91 -- Non-alcoholic beer

2202.99 -- Other

This heading covers non-alcoholic beverages, as defined in Note 3 to this

Chanter not classified tinder other headings, particularly heading 20.09 or

22.01.

(A) Waters, including mineral waters and aerated waters, con-

taining added sugar or other sweetening matter or flavoured.

This group includes, inter alia :

(1) Sweetened or flavoured mineral waters (natural or arti-

ficial).

(2) Beverages such as lemonade, orangeade, cola, consist-

ing of ordinary drinking water, sweetened or not, fla-

voured with fruit juices or essences, or compound ex-

tracts, to which citric and or tartaric acid are sometimes

GST LAW TIMES 28th May 2020 147