Page 69 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 69

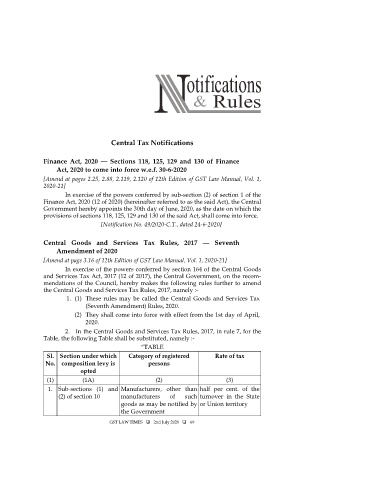

Central Tax Notifications

Finance Act, 2020 — Sections 118, 125, 129 and 130 of Finance

Act, 2020 to come into force w.e.f. 30-6-2020

[Amend at pages 2.25, 2.88, 2.119, 2.120 of 12th Edition of GST Law Manual, Vol. 1,

2020-21]

In exercise of the powers conferred by sub-section (2) of section 1 of the

Finance Act, 2020 (12 of 2020) (hereinafter referred to as the said Act), the Central

Government hereby appoints the 30th day of June, 2020, as the date on which the

provisions of sections 118, 125, 129 and 130 of the said Act, shall come into force.

[Notification No. 49/2020-C.T., dated 24-6-2020]

Central Goods and Services Tax Rules, 2017 — Seventh

Amendment of 2020

[Amend at page 3.16 of 12th Edition of GST Law Manual, Vol. 1, 2020-21]

In exercise of the powers conferred by section 164 of the Central Goods

and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recom-

mendations of the Council, hereby makes the following rules further to amend

the Central Goods and Services Tax Rules, 2017, namely :-

1. (1) These rules may be called the Central Goods and Services Tax

(Seventh Amendment) Rules, 2020.

(2) They shall come into force with effect from the 1st day of April,

2020.

2. In the Central Goods and Services Tax Rules, 2017, in rule 7, for the

Table, the following Table shall be substituted, namely :-

“TABLE

Sl. Section under which Category of registered Rate of tax

No. composition levy is persons

opted

(1) (1A) (2) (3)

1. Sub-sections (1) and Manufacturers, other than half per cent. of the

(2) of section 10 manufacturers of such turnover in the State

goods as may be notified by or Union territory

the Government

GST LAW TIMES 2nd July 2020 69