Page 73 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 73

2020 ] NOTIFICATIONS & RULES S7

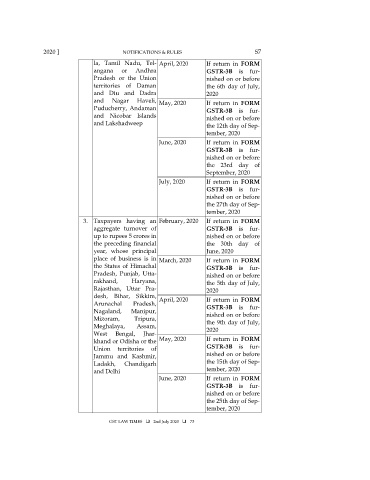

la, Tamil Nadu, Tel- April, 2020 If return in FORM

angana or Andhra GSTR-3B is fur-

Pradesh or the Union nished on or before

territories of Daman the 6th day of July,

and Diu and Dadra 2020

and Nagar Haveli, May, 2020 If return in FORM

Puducherry, Andaman GSTR-3B is fur-

and Nicobar Islands nished on or before

and Lakshadweep the 12th day of Sep-

tember, 2020

June, 2020 If return in FORM

GSTR-3B is fur-

nished on or before

the 23rd day of

September, 2020

July, 2020 If return in FORM

GSTR-3B is fur-

nished on or before

the 27th day of Sep-

tember, 2020

3. Taxpayers having an February, 2020 If return in FORM

aggregate turnover of GSTR-3B is fur-

up to rupees 5 crores in nished on or before

the preceding financial the 30th day of

year, whose principal June, 2020

place of business is in March, 2020 If return in FORM

the States of Himachal GSTR-3B is fur-

Pradesh, Punjab, Utta- nished on or before

rakhand, Haryana, the 5th day of July,

Rajasthan, Uttar Pra- 2020

desh, Bihar, Sikkim, April, 2020 If return in FORM

Arunachal Pradesh, GSTR-3B is fur-

Nagaland, Manipur, nished on or before

Mizoram, Tripura, the 9th day of July,

Meghalaya, Assam,

West Bengal, Jhar- 2020

khand or Odisha or the May, 2020 If return in FORM

Union territories of GSTR-3B is fur-

Jammu and Kashmir, nished on or before

Ladakh, Chandigarh the 15th day of Sep-

and Delhi tember, 2020

June, 2020 If return in FORM

GSTR-3B is fur-

nished on or before

the 25th day of Sep-

tember, 2020

GST LAW TIMES 2nd July 2020 73