Page 70 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 70

S4 GST LAW TIMES [ Vol. 38

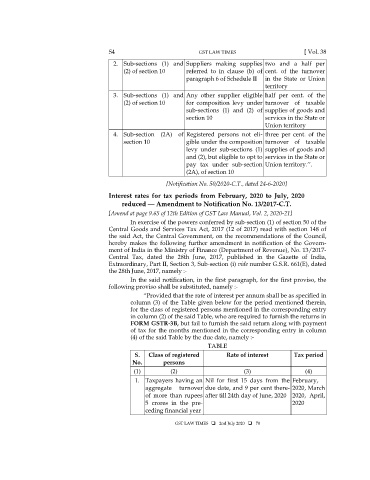

2. Sub-sections (1) and Suppliers making supplies two and a half per

(2) of section 10 referred to in clause (b) of cent. of the turnover

paragraph 6 of Schedule II in the State or Union

territory

3. Sub-sections (1) and Any other supplier eligible half per cent. of the

(2) of section 10 for composition levy under turnover of taxable

sub-sections (1) and (2) of supplies of goods and

section 10 services in the State or

Union territory

4. Sub-section (2A) of Registered persons not eli- three per cent. of the

section 10 gible under the composition turnover of taxable

levy under sub-sections (1) supplies of goods and

and (2), but eligible to opt to services in the State or

pay tax under sub-section Union territory.’’.

(2A), of section 10

[Notification No. 50/2020-C.T., dated 24-6-2020]

Interest rates for tax periods from February, 2020 to July, 2020

reduced — Amendment to Notification No. 13/2017-C.T.

[Amend at page 9.65 of 12th Edition of GST Law Manual, Vol. 2, 2020-21]

In exercise of the powers conferred by sub-section (1) of section 50 of the

Central Goods and Services Tax Act, 2017 (12 of 2017) read with section 148 of

the said Act, the Central Government, on the recommendations of the Council,

hereby makes the following further amendment in notification of the Govern-

ment of India in the Ministry of Finance (Department of Revenue), No. 13/2017-

Central Tax, dated the 28th June, 2017, published in the Gazette of India,

Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 661(E), dated

the 28th June, 2017, namely :-

In the said notification, in the first paragraph, for the first proviso, the

following proviso shall be substituted, namely :-

“Provided that the rate of interest per annum shall be as specified in

column (3) of the Table given below for the period mentioned therein,

for the class of registered persons mentioned in the corresponding entry

in column (2) of the said Table, who are required to furnish the returns in

FORM GSTR-3B, but fail to furnish the said return along with payment

of tax for the months mentioned in the corresponding entry in column

(4) of the said Table by the due date, namely :-

TABLE

S. Class of registered Rate of interest Tax period

No. persons

(1) (2) (3) (4)

1. Taxpayers having an Nil for first 15 days from the February,

aggregate turnover due date, and 9 per cent there- 2020, March

of more than rupees after till 24th day of June, 2020 2020, April,

5 crores in the pre- 2020

ceding financial year

GST LAW TIMES 2nd July 2020 70