Page 75 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 75

2020 ] NOTIFICATIONS & RULES S9

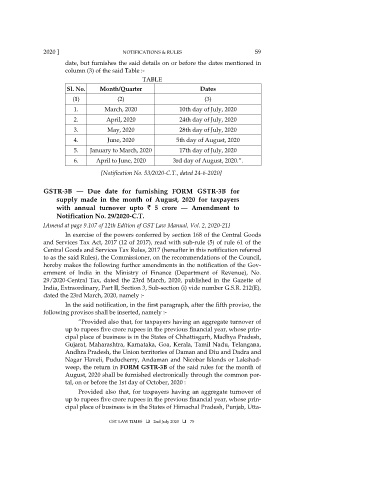

date, but furnishes the said details on or before the dates mentioned in

column (3) of the said Table :-

TABLE

Sl. No. Month/Quarter Dates

(1) (2) (3)

1. March, 2020 10th day of July, 2020

2. April, 2020 24th day of July, 2020

3. May, 2020 28th day of July, 2020

4. June, 2020 5th day of August, 2020

5. January to March, 2020 17th day of July, 2020

6. April to June, 2020 3rd day of August, 2020.”.

[Notification No. 53/2020-C.T., dated 24-6-2020]

GSTR-3B — Due date for furnishing FORM GSTR-3B for

supply made in the month of August, 2020 for taxpayers

with annual turnover upto ` 5 crore — Amendment to

Notification No. 29/2020-C.T.

[Amend at page 9.107 of 12th Edition of GST Law Manual, Vol. 2, 2020-21]

In exercise of the powers conferred by section 168 of the Central Goods

and Services Tax Act, 2017 (12 of 2017), read with sub-rule (5) of rule 61 of the

Central Goods and Services Tax Rules, 2017 (hereafter in this notification referred

to as the said Rules), the Commissioner, on the recommendations of the Council,

hereby makes the following further amendments in the notification of the Gov-

ernment of India in the Ministry of Finance (Department of Revenue), No.

29/2020-Central Tax, dated the 23rd March, 2020, published in the Gazette of

India, Extraordinary, Part II, Section 3, Sub-section (i) vide number G.S.R. 212(E),

dated the 23rd March, 2020, namely :-

In the said notification, in the first paragraph, after the fifth proviso, the

following provisos shall be inserted, namely :-

“Provided also that, for taxpayers having an aggregate turnover of

up to rupees five crore rupees in the previous financial year, whose prin-

cipal place of business is in the States of Chhattisgarh, Madhya Pradesh,

Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana,

Andhra Pradesh, the Union territories of Daman and Diu and Dadra and

Nagar Haveli, Puducherry, Andaman and Nicobar Islands or Lakshad-

weep, the return in FORM GSTR-3B of the said rules for the month of

August, 2020 shall be furnished electronically through the common por-

tal, on or before the 1st day of October, 2020 :

Provided also that, for taxpayers having an aggregate turnover of

up to rupees five crore rupees in the previous financial year, whose prin-

cipal place of business is in the States of Himachal Pradesh, Punjab, Utta-

GST LAW TIMES 2nd July 2020 75