Page 74 - GSTL_2nd July 2020 _Vol 38_Part 1

P. 74

S8 GST LAW TIMES [ Vol. 38

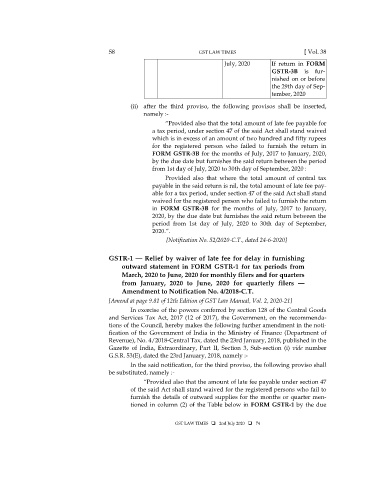

July, 2020 If return in FORM

GSTR-3B is fur-

nished on or before

the 29th day of Sep-

tember, 2020

(ii) after the third proviso, the following provisos shall be inserted,

namely :-

“Provided also that the total amount of late fee payable for

a tax period, under section 47 of the said Act shall stand waived

which is in excess of an amount of two hundred and fifty rupees

for the registered person who failed to furnish the return in

FORM GSTR-3B for the months of July, 2017 to January, 2020,

by the due date but furnishes the said return between the period

from 1st day of July, 2020 to 30th day of September, 2020 :

Provided also that where the total amount of central tax

payable in the said return is nil, the total amount of late fee pay-

able for a tax period, under section 47 of the said Act shall stand

waived for the registered person who failed to furnish the return

in FORM GSTR-3B for the months of July, 2017 to January,

2020, by the due date but furnishes the said return between the

period from 1st day of July, 2020 to 30th day of September,

2020.”.

[Notification No. 52/2020-C.T., dated 24-6-2020]

GSTR-1 — Relief by waiver of late fee for delay in furnishing

outward statement in FORM GSTR-1 for tax periods from

March, 2020 to June, 2020 for monthly filers and for quarters

from January, 2020 to June, 2020 for quarterly filers —

Amendment to Notification No. 4/2018-C.T.

[Amend at page 9.81 of 12th Edition of GST Law Manual, Vol. 2, 2020-21]

In exercise of the powers conferred by section 128 of the Central Goods

and Services Tax Act, 2017 (12 of 2017), the Government, on the recommenda-

tions of the Council, hereby makes the following further amendment in the noti-

fication of the Government of India in the Ministry of Finance (Department of

Revenue), No. 4/2018-Central Tax, dated the 23rd January, 2018, published in the

Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number

G.S.R. 53(E), dated the 23rd January, 2018, namely :-

In the said notification, for the third proviso, the following proviso shall

be substituted, namely :-

“Provided also that the amount of late fee payable under section 47

of the said Act shall stand waived for the registered persons who fail to

furnish the details of outward supplies for the months or quarter men-

tioned in column (2) of the Table below in FORM GSTR-1 by the due

GST LAW TIMES 2nd July 2020 74